Walk into any grocery store in 2025, and you’ll find something remarkable: store brand products occupying premium shelf space, sporting sophisticated packaging, and commanding prices that sometimes rival national brands. This isn’t your grandmother’s generic “no-name” product. Private labels, store brands manufactured by third parties but sold under a retailer’s name, have fundamentally transformed from budget alternatives into strategic powerhouses that generated $271 billion in U.S. sales in 2024 alone.

The pricing story behind this transformation reveals more than simple cost-cutting. It demonstrates how retailers discovered that transparent, value-aligned pricing could shift consumer perception, build loyalty, and reshape entire categories. When 99.9% of American households purchase at least one private label product, understanding the economics behind those price tags becomes essential for both shoppers making informed decisions and businesses navigating competitive retail landscapes.

This research examines how private label pricing actually works, from manufacturing cost structures to psychological pricing strategies, and why store brands no longer mean “settling for less.”

The Economics Behind Private Label Pricing

Why Private Labels Cost Less: Manufacturing Reality

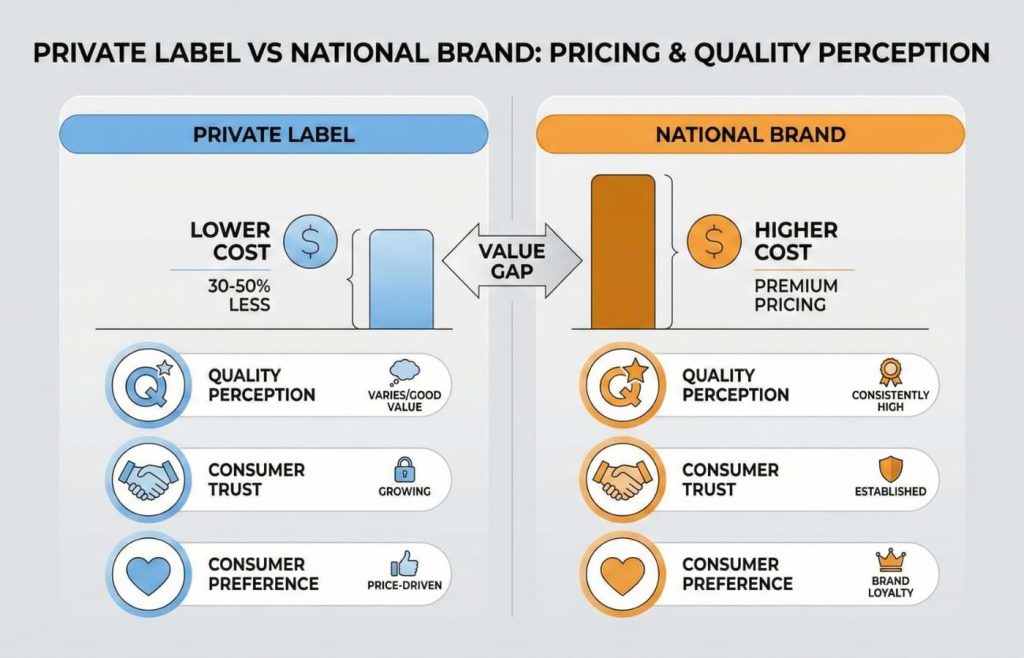

Private label products typically retail for 20-40% less than comparable national brands, but this discount doesn’t stem from inferior quality. The price difference reflects fundamentally different business models:

Cost Structure Comparison:

| Expense Category | National Brand | Private Label | Savings Source |

| Manufacturing | Moderate | 40-50% lower | No brand licensing fees, streamlined production |

| Marketing/Advertising | 15-20% of revenue | Minimal to zero | Relies on retailer’s existing customer base |

| Distribution | Multi-tier markup | Direct to retailer | Eliminates middleman costs |

| Relies on the retailer’s existing customer base | 3-5% of revenue | Category-dependent | Leverages proven formulations |

| Trade Promotions | 20-25% of revenue | Retailer-controlled | No slotting fees or promotional allowances |

According to Private Label Manufacturers Association (PLMA) market analysis, these structural advantages allow retailers to offer genuine value without compromising product quality. The manufacturing cost savings, estimated at 40-50% lower than branded equivalents, provide pricing flexibility that benefits both retailers and consumers.

Margin Mathematics: Who Profits From Store Brands?

The conventional wisdom that private labels deliver dramatically higher retail margins tells only part of the story. While percentage margins appear impressive, the dollar reality is more nuanced:

Margin Analysis Example (Typical Grocery Category):

- National Brand: $5.00 retail price

- Wholesale cost: $3.75

- Retail margin: $1.25 (25% of retail)

- Penny profit: $1.25

- Private Label: $3.50 retail price

- Wholesale cost: $2.10

- Retail margin: $1.40 (40% of retail)

- Penny profit: $1.40

In this scenario, the retailer earns 15 cents more per unit on the store brand—a modest advantage that compounds dramatically across millions of transactions. However, as research from McKinsey’s retail analysis demonstrates, retailers investing in premium private label development face rising costs for ingredients, packaging, and marketing that can erode these margin advantages.

The real economic value extends beyond immediate profit: private labels provide leverage for negotiating better terms with national brands, differentiate retailers from competitors, and create customer loyalty that generates long-term revenue streams.

The Three-Tier Pricing Strategy: Good, Better, Best

How Retailers Structure Private Label Portfolios

Modern retailers abandoned the single “store brand” model years ago in favor of a tiered approach that serves different customer segments and price sensitivities:

1. Value Tier (Economy/Basic)

- Positioning: 30-40% below national brand equivalents

- Target customer: Price-conscious shoppers, large families, bulk buyers

- Examples: Walmart Great Value (select items), Target Up&Up basics

- Growth trend: +35% from 2021-2024

2. Mid-Market Tier (Premium)

- Positioning: 20-25% below national brand equivalents

- Target customer: Quality-focused mainstream shoppers

- Examples: Kroger Simple Truth, Costco Kirkland Signature

- Growth trend: +65% from 2021-2024

3. Premium Tier (Ultra-Premium/Specialty)

- Positioning: $1-3 below national brands, or at parity

- Target customer: Affluent shoppers, specialty food enthusiasts

- Examples: Whole Foods 365 Organic, Trader Joe’s specialty items, Walmart bettergoods

- Growth trend: +76% from 2021-2024

These tiers don’t exist in isolation—they’re carefully calibrated to capture different spending occasions and shopping missions. A consumer might buy value-tier paper towels, mid-tier pasta, and premium-tier olive oil in the same shopping trip, demonstrating that private label pricing strategies now compete across the entire value spectrum.

The Premium Private Label Paradox

The fastest-growing segment of private labels challenges everything consumers once believed about store brands. Premium private labels often cost only $1-3 less than leading national brands, yet NielsenIQ consumer research shows that 46% of Millennials and Gen Z consumers will pay more for private label products they enjoy, a statistic that would have been unthinkable a decade ago.

Consider Walmart’s bettergoods line, launched in 2024: in post-launch surveys, 70% of buyers didn’t realize it was a Walmart brand. They purchased based on perceived quality, innovative flavors, and premium positioning, not price alone. This perception shift represents the most significant change in private label pricing psychology in generations.

Consumer Perception Shift: From “Cheap” to “Smart Choice”

The Quality Perception Revolution

For decades, private labels suffered from a persistent quality stigma: consumers were willing to sacrifice satisfaction for savings. That equation has inverted. Current consumer sentiment data reveals a fundamental perception transformation:

Quality Perception Statistics (2024-2025):

- 80% of U.S. consumers rate private label quality equal to or better than national brands

- 71% of global shoppers rate store brands equal or superior in quality

- 68% view private labels as suitable alternatives to name brands

- 55% of consumers increased private label purchases year-over-year

This shift didn’t occur organically; it resulted from deliberate retailer investments in product development, quality control, and sophisticated packaging that rivals or surpasses national brands. When Target launched its Good & Gather food brand with clean ingredients and a contemporary design, consumers responded by driving it to $2 billion in sales within the first year.

The Price-Value Equation: What Drives Purchase Decisions

Understanding why consumers choose private labels requires looking beyond simple price tags. Research identifies a hierarchy of motivations that inform purchase decisions:

Primary Purchase Motivators (Ranked by Consumer Surveys):

- Value for money (72% of respondents)

- Perception that the price-to-quality ratio exceeds that of national brands

- Lower price/sale price (71%)

- Immediate cost savings, especially during economic uncertainty

- Product quality (42%, up from 30% in 2023)

- Growing confidence in manufacturing standards

- Taste/performance (33%, up from 26% in 2023)

- Blind taste tests often show parity or preference for store brands

- Brand trust (29%)

- Retailer reputation transfers to private label products

Notice that quality now ranks nearly as high as price, a dramatic departure from the cost-first mentality that defined previous generations of private label shoppers. This evolution allows retailers to price premium private labels closer to national brand equivalents while maintaining consumer confidence.

Demographic Differences: Who Buys Private Label and Why

The stereotype of private label buyers as exclusively budget-conscious shoppers no longer holds. Modern private label adoption cuts across income brackets and generations:

Private Label Adoption by Demographic:

| Demographic | Purchase Frequency | Primary Motivation | Preferred Tier |

| Gen Z | 71% buy regularly | Price flexibility + sustainability | Value + Premium (polarized) |

| Millennials | 68% buy regularly | Quality parity perception + convenience | Mid-market + Premium |

| Gen X | 64% buy regularly | Value for money | Mid-market |

| Baby Boomers | 52% buy regularly | Price savings | Value + Mid-market |

| High Income ($100K+) | 58% switching from national brands | Quality confidence + smart shopping identity | Premium tier |

The high-income statistic deserves particular attention: affluent consumers increasingly view private label purchases as savvy decision-making rather than financial necessity. This psychological shift, from “I have to buy store brands” to “I choose to buy store brands,” fundamentally altered private label pricing power.

Strategic Pricing: How Retailers Set Store Brand Prices

The Anchor Pricing Method

Most private label pricing doesn’t start with cost-plus calculations it starts with national brand price points. Retailers use what economists call “anchor pricing”: setting private label prices at strategic discounts to comparable branded products to maximize perceived value while maintaining profitability.

Standard Anchor Pricing Framework:

- Identify the national brand leader in the category

- Assess competitive set (typically 2-4 leading brands)

- Calculate the average brand price across the category

- Set private label price at appropriate discount tier:

- Premium tier: 5-15% below

- Mid-market tier: 20-25% below

- Value tier: 30-40% below

This approach explains why store brand milk might be priced 30% below national brands (commodity category with low differentiation), while private label beauty products might only be 10-15% below (higher perceived brand value).

As retail environments incorporate dynamic pricing capabilities, some retailers adjust private label prices algorithmically based on competitor movements, inventory levels, and demand signals, though this remains less common than static anchor pricing.

Category-Specific Pricing Logic

Not all product categories receive identical private label pricing treatment. Retailers strategize based on consumer purchase patterns, brand loyalty strength, and competitive dynamics:

High Private Label Penetration Categories (Low Brand Loyalty):

- Paper products: 35-40% below national brands

- Sugar, flour, basic staples: 35-45% below

- Milk and dairy basics: 25-35% below

- Bottled water: 30-40% below

Moderate Private Label Penetration (Mixed Loyalty):

- Canned vegetables: 25-30% below

- Frozen foods: 20-30% below

- Cleaning supplies: 20-25% below

Low Private Label Penetration (High Brand Loyalty):

- Soft drinks: 15-20% below (when offered)

- Pet food: 15-25% below

- Salty snacks: 15-20% below

- Condiments/sauces: 20-25% below

Categories with strong brand loyalty require more aggressive discounting to overcome consumer resistance. Conversely, commodity-like products where quality differences are minimal can command smaller discounts while still capturing significant market share.

Psychological Pricing Tactics

Beyond anchor pricing, retailers employ subtle pricing strategies that influence purchase decisions without consumers consciously recognizing the manipulation:

Charm Pricing Application: Store brands frequently use prices ending in .99 or .98 (e.g., $2.99 vs. $3.00) to create a perception of value, even though the difference is trivial. Research shows this tactic remains effective even as consumers become aware of it.

Price Pack Architecture: Retailers carefully structure pack sizes to create favorable price-per-unit comparisons. A private label 24-ounce product at $3.99 might be positioned against a national brand 20-ounce at $4.49—making the store brand appear superior on both absolute price and unit economics. For deeper insights into how package sizing influences pricing perception, see our analysis of price pack architecture.

Threshold Pricing: Strategic positioning just below psychological price thresholds ($4.99 instead of $5.19, even when the margin allows higher pricing) maintains consumer perception of value tier membership.

The Market Growth Story: Private Labels Redefining Retail

Record-Breaking Sales Performance

Private label growth has outpaced national brand growth consistently since 2020, with the gap widening rather than narrowing:

U.S. Private Label Market Growth (2019-2025):

| Year | Total Sales | YoY Growth | Market Share | Household Penetration |

| 2019 | $176 billion | — | 17.7% | 93.4% |

| 2020 | $194 billion | +10.2% | 18.1% | 95.8% |

| 2021 | $215 billion | +10.8% | 18.4% | 97.2% |

| 2022 | $226 billion | +5.1% | 18.7% | 98.5% |

| 2023 | $261 billion | +15.5% | 19.2% | 99.5% |

| 2024 | $271 billion | +3.9% | 20.5% | 99.9% |

| 2025 (projected) | $280 billion | +3.3% | 21.0% | 99.9% |

These figures, compiled from PLMA and Circana data, reveal sustained momentum even as inflation moderates. Perhaps more telling: since 2021, private label unit sales rose 2% while national brand unit sales fell 7%, indicating that consumers’ shift toward store brands reflects preference, not just economic necessity.

Global Market Perspective

The United States lags significantly behind European markets in private label adoption, suggesting substantial room for continued growth:

Private Label Market Share by Region (2024):

- Europe: 39% of grocery market value (~$412 billion)

- Spain: 51% market share

- Switzerland: 49%

- United Kingdom: 43%

- Germany: 41%

- United States: 20.5% of grocery market value ($271 billion)

- Latin America: 14.2% year-over-year growth (fastest growing)

- Middle East/Africa: 34.3% year-over-year growth

European consumers have long embraced private labels as quality equivalents to national brands, a cultural shift that U.S. consumers are now experiencing. If American private label adoption merely approaches European levels, it would represent a market expansion exceeding $400 billion.

Category Performance: Where Private Labels Win

Private label success varies dramatically by product category, with some approaching dominance while others remain niche:

Top Private Label Categories by Dollar Share (2024):

- Milk: 67% private label share

- Sugar: 58%

- Bottled water: 47%

- Fresh eggs: 45%

- Paper products: 41%

- Canned vegetables: 38%

- Cheese: 35%

- Frozen vegetables: 34%

Fastest Growing Private Label Categories (2023-2024):

- Refrigerated foods: +7.5% dollar sales growth

- Snacks and candy: +6.8%

- Beverages: +6.2%

- General food: +4.0%

- Health and beauty: +3.8%

Notice the shift: high-growth categories now include discretionary purchases (snacks, beverages) rather than only necessities. This expansion into premium and specialty categories explains why private label pricing strategies have become more sophisticated; retailers aren’t just competing on cost, they’re competing on experience and innovation.

Pricing Transparency vs. Pricing Psychology

The Hidden Costs Consumers Don’t See

While private label pricing appears straightforward, a lower shelf price equals better value, the complete cost picture includes factors consumers rarely consider:

Total Cost of Ownership Considerations:

Yield Differences: A $3.99 private label laundry detergent with 32 loads costs $0.125 per load. A $7.99 national brand with 80 loads costs $0.100 per load, making the national brand cheaper per use despite a higher sticker price.

Quality Variability: Some private label items match national brand performance exactly (often manufactured in the same facilities), while others may require using more product or replacing items more frequently. Without transparent quality metrics, price-per-unit comparisons can mislead.

Return/Satisfaction Risk: If a $4 private label product disappoints, the customer wastes $4. If an $8 national brand disappoints, they waste $8, but national brands typically have longer track records, reducing purchase risk. This “regret cost” isn’t reflected in shelf prices.

Innovation Lag: National brands invest heavily in new formulations, ingredients, and technology. Private labels typically follow proven formulas. Consumers valuing cutting-edge features may find private label pricing artificially low because it doesn’t include innovation costs.

Shrinkflation and Private Labels

As national brands increasingly use shrinkflation, reducing product size while maintaining price to disguise price increases, private labels face a strategic decision: follow suit or maintain package size to emphasize value.

Many retailers choose package size consistency as a differentiation tool, making private labels appear more honest and transparent. A national brand’s 18-ounce jar at $4.99 competes against a private label’s 20-ounce jar at $3.99—the absolute price gap is $1, but the price-per-ounce gap is 23%. This tactic reinforces consumer perception that private labels offer superior value and transparency.

The Role of Pricing Tags in Purchase Decisions

How retailers display private label prices, both physically and psychologically, significantly impacts purchase rates. Shelf tags highlighting “Compare to [National Brand]” with percentage savings attract price-conscious shoppers, while minimalist premium private label packaging deliberately avoids price emphasis to compete on quality perception.

For more on how pricing tags influence consumer behavior and why format matters as much as the number itself, understanding shelf communication becomes essential to comprehending private label success.

Business Implications: Strategic Considerations for Retailers and Brands

For Retailers: Balancing Private Label Growth

While private label expansion appears universally beneficial for retailers, strategic risks exist:

Overdependence Risk: Retailers deriving too much revenue from private labels (>40% of sales) may lose negotiating power with national brand manufacturers and face consumer backlash if quality issues arise. Successful retailers maintain portfolio balance.

Quality Control Burden: National brands own their reputations; private label quality issues damage retailer brands directly. One contamination scandal or quality failure can undermine years of private label investment.

Innovation Gap: Retailers lack the R&D infrastructure of major CPG companies. Following established formulas works until category-defining innovations emerge that consumers demand.

Channel Conflict: As private labels capture more share, national brand manufacturers may reduce innovation support, promotional funding, or even limit product availability to retailers they view as competitive threats.

For National Brands: Competing With Private Labels

National brands face existential questions as private labels claim increasing market share:

Strategic Response Options:

- Premium Positioning: Focus on innovation, brand equity, and features that private labels can’t easily replicate. Differentiate through proprietary technology, ingredients, or formulations.

- Price Gap Management: Monitor private label pricing and adjust national brand prices to maintain value perception within acceptable ranges (generally 20-30% premium).

- Co-Manufacturing: Some national brands manufacture private label products for retailers, an “if you can’t beat them, join them” strategy that generates revenue while potentially undermining their own brands.

- Speed to Market: Private labels typically follow trends rather than create them. National brands can leverage faster innovation cycles to stay ahead of store brand copycats.

- Category Defense: Focus resources on categories where brand loyalty remains strong (prepared foods, salty snacks, pet food) rather than commoditized categories where private labels dominate.

Outcome-Based Pricing Models

Some forward-thinking retailers experiment with outcome-based pricing for private label products, linking price to verified results or consumer satisfaction rather than fixed shelf prices. While still nascent in retail grocery, this approach could redefine value perception for premium private labels by explicitly connecting price to performance guarantees.

FAQ

Why are private-label products cheaper than national brands?

Private labels cost 20-40% less than national brands primarily due to structural cost differences, not quality compromises. Store brands eliminate marketing expenses (15-20% of national brand costs), reduce distribution costs by selling directly to retailers, avoid trade promotion spending (20-25% of revenue), and operate with lower manufacturing costs (40-50% savings) by forgoing brand licensing fees. These savings enable lower retail prices while maintaining retailer profitability.

Are private-label products lower quality than national brands?

Not systematically. Consumer research from NielsenIQ shows 80% of U.S. consumers rate private label quality equal to or better than national brands. Many private-label products are manufactured in the same facilities as national brands, using identical or very similar formulations. The quality gap that once defined private labels has narrowed dramatically due to retailer investments in product development, quality control, and sourcing. However, quality can vary by category and retailer; premium private label tiers often match or exceed national brand standards, while value tiers may use simpler formulations.

How much can I save by buying private-label instead of national brands?

Savings vary significantly by category and product tier. Typical ranges:

- Commodity categories (milk, sugar, water): 30-40% savings

- Packaged foods (pasta, canned goods): 20-30% savings

- Household products (paper towels, detergent): 25-35% savings

- Premium private labels (specialty foods, organic items): 5-15% savings

A household spending $200 weekly on groceries could save $25-50 by switching comparable items to private label equivalents, approximately $1,300-2,600 annually. However, true savings depend on yield differences (loads per detergent bottle, servings per package) and performance parity.

Why do some private label products cost almost as much as national brands?

Premium private label products (Trader Joe’s specialty items, Whole Foods 365 Organic, Walmart bettergoods) deliberately price closer to national brands, often just $1-3 less, to signal quality parity rather than budget alternative status. These products target consumers prioritizing quality, innovation, and specialty features over maximum cost savings. Premium private labels also face higher ingredient costs (organic, specialty sourcing), sophisticated packaging expenses, and positioning strategies that emphasize aspiration over value. The modest discount acknowledges consumers still perceive national brand equity value, but the smaller gap reflects genuine quality investment.

Do retailers make more money on private label products?

In percentage terms, yes, private labels deliver 25-30% higher gross margins compared to national brands. However, the dollar profit (penny profit) advantage is smaller than commonly believed. A $5 national brand with 25% retail margin yields $1.25 profit, while a $3.50 private label with 40% margin yields $1.40, only 15 cents more. The real economic value extends beyond the immediate margin: private labels provide negotiating leverage with national brands, differentiate retailers from competitors, and build customer loyalty that generates long-term value.

Are private-label products the same as national brands, just in different packaging?

Sometimes, but not always. Three scenarios exist:

- Identical products: Manufactured in the same facility with identical formulations, only packaging differs (common for commodity items)

- Similar formulations: Based on national brand specifications but with minor ingredient or quality adjustments to meet price targets

- Unique products: Custom formulations developed specifically for the private label with no direct national brand equivalent

Retailers rarely disclose manufacturing sources, so consumers can’t systematically identify which scenario applies. However, blind taste tests and quality comparisons frequently show private labels matching or exceeding national brand performance, particularly in premium tiers.

Why are private labels growing faster than national brands?

Five factors drive accelerated private label growth:

- Quality perception shift: Consumers no longer associate store brands with inferior products

- Economic pressure: Inflation and cost-consciousness push shoppers toward value alternatives

- Retailer investment: Sophisticated product development, packaging, and marketing rival national brand efforts

- Generational attitudes: Millennials and Gen Z lack the brand loyalty of older generations

- Premiumization: Expansion beyond value tiers into specialty and premium categories attracts new customer segments

In 2024, private label sales grew 3.9% while national brands grew only 1%, a gap that compounds over time. Since 2021, private label unit sales rose 2% while national brand units fell 7%, indicating a sustained preference shift beyond temporary economic necessity.

How do retailers decide what to price their private label products?

Retailers use anchor pricing strategies based on national brand price points rather than cost-plus calculations. The process:

- Identify leading national brand(s) in the category

- Calculate the average competitive price

- Set private label price at strategic discount:

- Premium tier: 5-15% below national brands

- Mid-market tier: 20-25% below

- Value tier: 30-40% below

- Adjust based on category dynamics (brand loyalty, quality perception, competitive intensity)

This approach explains category-specific pricing variation, retailers discount aggressively in commodity categories with weak brand loyalty (paper products at 35% below) while pricing closer to national brands in categories where consumers perceive meaningful differences (specialty foods at 10% below).

Can private label pricing indicate quality?

Yes, within the same retailer’s portfolio. Retailers deliberately structure three-tier pricing to signal quality levels: value tier products (30-40% below national brands) communicate budget-friendly basics, mid-market offerings (20-25% below) signal mainstream quality, and premium tiers (5-15% below or at parity) indicate specialty or superior ingredients. However, cross-retailer comparisons complicate this signal; Costco Kirkland Signature’s mid-tier pricing often delivers premium quality, while discount grocers’ premium tiers may only match mainstream quality at conventional supermarkets. Brand reputation and retailer positioning matter as much as absolute price.

What private label pricing trends should consumers watch?

Three emerging trends reshape private label pricing:

- Premiumization acceleration: Fastest-growing tier (76% growth 2021-2024) as retailers invest in specialty products that command higher prices with smaller discounts to national brands

- Transparency emphasis: Some retailers highlight cost structure and manufacturing transparency to justify pricing and build trust

- Dynamic pricing adoption: Limited but growing use of algorithmic pricing that adjusts store brand prices based on demand signals, inventory, and competitive moves, though still less common than static shelf pricing

These trends suggest private label pricing will become more sophisticated and segmented rather than uniformly driving toward the lowest-cost positioning.

Conclusion

Private label pricing stands at an inflection point. The historical equation, that store brands mean sacrificing quality for savings, has dissolved. Today’s private labels compete on multiple dimensions: cost leadership in commodity categories, quality parity in mainstream tiers, and innovation leadership in premium segments.

This transformation creates new dynamics for all stakeholders. Consumers gain choice and value, but face more complex decision-making as private labels expand across price tiers. Retailers build differentiation and margins, but assume quality risks and innovation burdens previously owned by national brand manufacturers. National brands confront existential challenges, forcing strategic choices about where and how to compete against well-funded, sophisticated store brand programs.

The pricing transparency that defines successful private labels today, clear value propositions, honest package sizing, and credible quality claims, represents a market correction after decades of national brand pricing power. As adoption approaches European levels and younger generations embrace store brands without stigma, private label pricing will continue evolving from “cheap alternative” positioning toward “smart choice” positioning across all income levels.

For consumers seeking to understand whether private label pricing delivers genuine value or merely exploits perception, the answer increasingly depends on category, tier, and individual product evaluation rather than blanket assumptions about store brands. The 99.9% household penetration rate suggests Americans have already made their judgment: private labels earn their shelf space through performance, not just price.