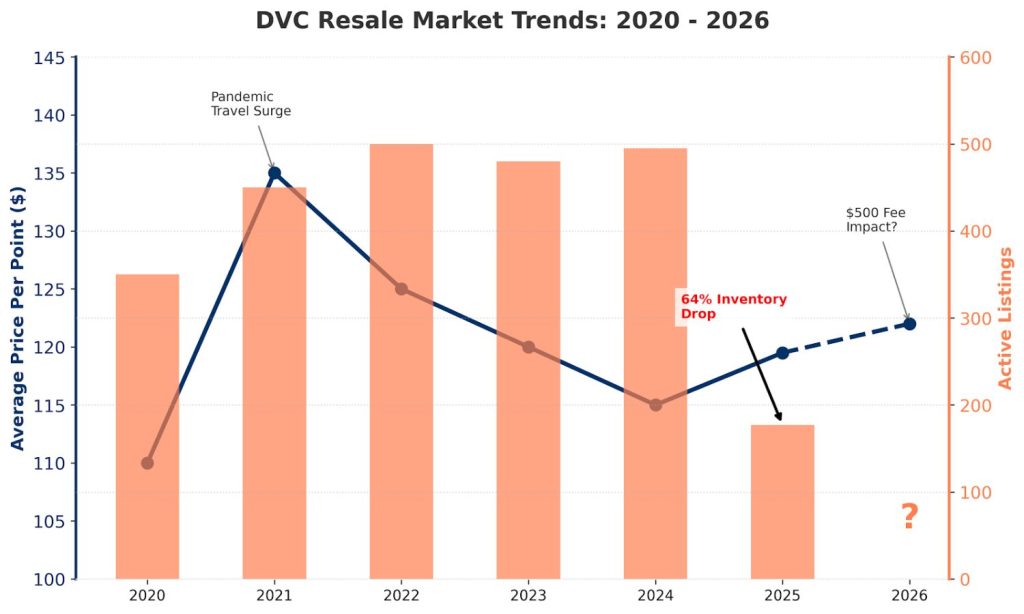

DVC resale inventory has dropped 64% year-over-year, falling from 495 active listings in December 2024 to just 177 listings in December 2025. This historic shortage is driving increased competition among buyers and putting upward pressure on prices heading into 2026.

The DVC Resale Inventory Crisis: Breaking Down the Numbers

The Disney Vacation Club resale market is experiencing an unprecedented inventory shortage that’s reshaping how buyers and sellers approach timeshare transactions. If you’ve been monitoring DVC contract availability, you’ve likely noticed something alarming: finding a good deal has become significantly harder.

The numbers tell a compelling story. Active DVC resale listings plummeted from 495 contracts in late 2024 to just 177 contracts by December 2025. That’s a 64% year-over-year decline in available inventory, creating the tightest seller’s market the DVC resale community has seen in years.

This shortage isn’t just a temporary blip. Throughout 2025, inventory steadily contracted from over 500 listings in early spring to historic lows by fall, fundamentally changing the dynamics of DVC ownership transfers.

DVC Resale Market Trends: 2020-2026

Price Per Point vs Inventory | 64% YoY Drop

DVC Resale Inventory Tracker: 2025 Monthly Breakdown

Understanding how inventory shifted throughout 2025 helps buyers and sellers anticipate market conditions. Here’s the complete monthly inventory data:

| Month | Active Listings | Change from Previous Month | Year-over-Year Change |

|---|---|---|---|

| February 2025 | 545 | +10% from Nov 2024 | Buyer’s market |

| March 2025 | 545 | Stable | Balanced |

| April 2025 | 502 | -8% | Tightening |

| May 2025 | ~480 | -4% | Tightening |

| June 2025 | ~400 | -17% | Shifting |

| July 2025 | ~320 | -20% | Seller advantage |

| August 2025 | 180 | -44% | Historic low |

| September 2025 | ~200 | +11% | Tight supply |

| October 2025 | 242 | +21% | -51% YoY |

| November 2025 | ~200 | -17% | Critical shortage |

| December 2025 | 177 | -12% | -64% YoY |

Data compiled from DVC Resale Market broker reports and industry tracking.

The trajectory is clear: what started as a balanced market in early 2025 transformed into a seller-favorable environment by summer, reaching critical shortage levels by year-end.

What’s Driving the DVC Resale Inventory Shortage?

Several interconnected factors explain why DVC owners are holding onto their contracts rather than selling:

1. Members Are Actually Using Their Points

The simplest explanation is often the most accurate. More DVC members are actively vacationing at Disney properties rather than letting points expire or selling contracts they don’t use. Post-pandemic travel demand remains strong, and Disney’s resort improvements have renewed member enthusiasm.

2. Disney’s Right of First Refusal (ROFR) Activity

Disney Vacation Club has been selectively exercising its Right of First Refusal throughout 2025, particularly at premium resorts like Grand Floridian and Bay Lake Tower. When Disney buys back contracts at below-market prices, those units never reach other buyers, further constraining available inventory.

ROFR activity creates a psychological floor for pricing. Sellers know Disney might snap up underpriced contracts, so they’re less likely to list at steep discounts.

3. Rising Annual Dues Concerns

The 2026 DVC annual dues increased between 3% and 9%, depending on the resort. Bay Lake Tower saw the largest jump at 9.06%, while Grand Floridian maintained the lowest dues at $8.31 per point. These increases may prompt some owners to sell eventually, but many are taking a wait-and-see approach.

4. The New $500 Contract Administration Fee

Effective January 1, 2026, Disney implemented a $500 Contract Administration Fee on all resale transactions. This new cost affects the economics of both buying and selling:

- For small contracts (50-75 points), the fee adds $6.67 to $10 per point to the effective purchase price

- For larger contracts (200+ points), the impact is less significant at $2.50 or less per point

- The fee’s introduction triggered a December 2025 buying rush as purchasers tried to close before the deadline

How Low Inventory Affects DVC Resale Prices?

The relationship between inventory and pricing follows classic supply-and-demand economics. Here’s how the 2025 inventory decline impacted average prices per point:

| Period | Average Price Per Point | Market Condition |

|---|---|---|

| Q1 2025 | $109-$119 | Buyer’s market |

| Q2 2025 | $118-$121 | Balanced |

| Q3 2025 | $122-$127 | Seller advantage |

| Q4 2025 | $121-$127 | Tight supply, volatile |

Key pricing observations:

- Grand Californian commands the highest resale prices at $250-$265 per point

- Vero Beach remains the most affordable at $42-$48 per point but carries the highest annual dues

- Riviera Resort trades at significant discounts due to resale restrictions limiting where points can be used

- The blended average across all resorts fluctuated between $118 and $127 throughout 2025

For buyers researching timeshare pricing strategies, DVC represents a unique market where resale discounts of 40-60% versus direct purchase prices remain achievable despite tightening inventory.

What Record-Low Inventory Means for DVC Buyers in 2026?

If you’re planning to purchase DVC points on the resale market this year, prepare for a different buying experience than existed even 12 months ago:

Expect faster decision timelines. Desirable contracts at competitive prices don’t sit on the market for weeks. Buyers who hesitate often lose out to faster-moving competitors.

Budget for the $500 administration fee. This cost is now standard on all resale transactions. Factor it into your per-point calculations, especially for smaller contracts where it has a proportionally greater impact.

Consider less popular resorts. While Grand Floridian and Polynesian contracts are scarce, resorts like Saratoga Springs, Animal Kingdom Lodge, and Old Key West often have better availability and lower price points.

Watch for direct price increases. Disney is raising direct purchase prices at several resorts effective February 10, 2026. When direct prices rise, resale values typically follow, meaning current inventory may represent a better value than future listings.

Similar dynamics appear in other vacation ownership pricing markets, where limited supply consistently drives premium pricing.

What Sellers Should Know About the Current Market?

For DVC owners considering selling, the current environment offers distinct advantages:

- Reduced competition means your listing faces fewer comparable contracts

- Buyer urgency has increased, leading to faster sales at asking prices

- Disney’s ROFR activity establishes price floors, protecting against lowball offers

- Rising dues may motivate buyers to lock in contracts before the 2027 increases

However, sellers should also consider:

- The $500 administration fee may become a negotiation point with buyers

- Contracts at resorts approaching deed expiration (2042 for several original resorts) face natural price pressure

- Resale restrictions on newer resorts like Riviera and Disneyland Hotel limit your buyer pool

DVC Resale Market Outlook: What to Watch in 2026

Several factors will shape inventory levels and pricing throughout 2026:

Potential inventory relief: Higher annual dues may prompt some owners to sell, gradually increasing available listings.

February direct price increases: Polynesian, Riviera, Fort Wilderness, Aulani, and Disneyland Hotel will see direct prices rise, potentially lifting resale valuations.

$500 fee market adjustment: As buyers and sellers adapt to the new administration fee, negotiation patterns will evolve.

ROFR trends: Disney’s buyback activity, particularly at Grand Floridian and Bay Lake Tower, will continue influencing pricing floors.

Frequently Asked Questions

Why is DVC resale inventory so low in 2026?

DVC resale inventory dropped 64% year-over-year due to increased member usage of points, Disney’s ROFR buyback activity, and owners hesitating to sell amid market uncertainty. Only 177 active listings existed in December 2025 compared to 495 the previous year.

How does low inventory affect DVC resale prices?

Limited inventory increases competition among buyers, putting upward pressure on prices. Average resale prices rose from $118 per point in June 2025 to $127 per point by September 2025 as inventory tightened.

Is 2026 a good time to buy DVC resale?

Despite tight inventory, resale still offers 40-60% savings versus direct purchase prices. However, buyers should act quickly on desirable contracts and budget for the new $500 administration fee. Waiting may mean higher prices if direct increases push resale values upward.

What is the $500 DVC Contract Administration Fee?

Effective January 1, 2026, Disney charges a $500 fee on all resale contract closings. This fee covers the administrative costs of transferring ownership and applies regardless of contract size or resort.

Which DVC resorts have the most resale availability?

Saratoga Springs, Old Key West, and Animal Kingdom Lodge typically have more resale listings than premium resorts like Grand Floridian, Polynesian, and Grand Californian. Availability varies monthly based on seller decisions and Disney’s ROFR activity.

The Bottom Line on DVC Resale Inventory

The 64% inventory decline represents a fundamental shift in DVC resale market dynamics. Buyers face increased competition and faster decision timelines, while sellers enjoy reduced competition and stronger pricing leverage.

For anyone researching Disney vacation ownership costs, understanding current inventory conditions is essential for realistic expectations and successful transactions. The market has moved decisively in sellers’ favor, and early 2026 indicators suggest this trend will continue until economic factors or policy changes motivate more owners to list their contracts.