Prices that change by the hour. Costs that spike during emergencies. Algorithms that charge different customers different amounts for identical products. These pricing practices have moved from ride-sharing apps into groceries, entertainment, and essential goods, raising urgent questions about legality, fairness, and consumer protection.

As of January 2026, state and federal regulators are actively rewriting the rules around algorithmic pricing. This guide explains what is legal, what crosses the line into exploitation, and how transparent pricing models protect both businesses and consumers.

Understanding Three Distinct Pricing Models

The pricing debate involves three different practices that are often confused but have distinct legal and ethical implications.

Dynamic Pricing

Dynamic pricing adjusts prices based on general market conditions like supply, demand, time of day, or seasonality. Airlines have used this for decades, charging more for peak travel times.

This practice is legal when based on objective market factors that apply equally to all customers. A hotel charging more during a major conference affects everyone booking during that period.

Surge Pricing

Surge pricing is a specific form of dynamic pricing that responds to sudden demand spikes. Ride-sharing platforms popularized this model, multiplying fares during rush hour or after large events.

The legality depends on transparency and context. Surge pricing during normal business operations is generally permitted. However, excessive price increases during declared emergencies trigger price gouging laws in most states.

Surveillance Pricing

Surveillance pricing uses personal data to charge different prices to different people for identical products at the same time. An algorithm might analyze your browsing history, location, device type, or purchase patterns to determine how much you will pay.

This practice faces the most aggressive regulatory scrutiny. Multiple states introduced legislation in 2025 to either ban it outright or require explicit disclosure.

| Pricing Type | What It Is | Current Legal Status | Consumer Impact |

| Dynamic Pricing | Changes based on market conditions | Legal when transparent | Predictable within parameters |

| Surge Pricing | Temporary spikes during high demand | Legal except during emergencies | Can feel exploitative |

| Surveillance Pricing | Personalized prices based on your data | Facing bans and disclosure laws | Hidden discrimination |

The Legal Landscape: State-by-State Regulations

The regulatory environment shifted dramatically in 2025, with states taking aggressive action while federal enforcement remains uncertain.

New York: First Disclosure Law

New York enacted the first algorithmic pricing disclosure law in May 2025, effective November 10, 2025. Any business using algorithms to set personalized prices based on personal data must display this notice: “This price was set by an algorithm using your personal data.”

The law exempts financial institutions, insurers, and certain subscription pricing. Violations carry civil penalties of $1,000 per violation. The National Retail Federation challenged the law on First Amendment grounds, arguing compelled speech, but enforcement has moved forward.

California: Anticompetitive Algorithmic Ban

California passed two laws in October 2025 targeting common pricing algorithms. The state banned using shared algorithmic pricing tools as part of any conspiracy to restrain trade. This addresses concerns about competitors using the same software to coordinate prices without direct communication.

The laws take effect January 1, 2026, and specifically prohibit coercing another business to adopt algorithmically recommended prices.

Widespread Legislative Activity

Between January and July 2025, 24 states introduced 51 bills targeting algorithmic pricing, up from just 10 bills in all of 2024. The legislative focus spans three areas:

- Algorithmic price fixing, particularly in rental housing markets where landlords use shared pricing software

- Surveillance pricing prohibitions and disclosure requirements

- Dynamic pricing restrictions for specific sectors like groceries, restaurants, and transportation

State Legislative Leaders: New York leads with seven algorithmic pricing bills in 2025, followed by California (five bills) and Massachusetts (four bills). Rhode Island, Arizona, and Maine have introduced legislation specifically targeting electronic shelf labels in grocery stores.

Price Gouging vs. Surge Pricing: The Critical Distinction

Price gouging laws exist in over 30 states, but they activate only under specific conditions and apply different standards than surge pricing restrictions.

When Price Gouging Laws Apply

Most state price gouging statutes require a declared state of emergency before they take effect. The declaration can come from the president, governor, or local officials, depending on state law.

California law prohibits charging more than 10 percent above pre-emergency prices for essential goods and services. For items a seller began offering after an emergency declaration, prices cannot exceed cost by more than 50 percent.

Texas does not set a specific threshold but prohibits “excessive or exorbitant” pricing on necessities during disasters. Courts evaluate whether prices significantly exceed typical values in the area.

Protected Categories

Price gouging protections typically cover:

- Food and drinking water

- Emergency supplies and medical equipment

- Fuel and energy

- Building materials and repair services

- Temporary housing and hotels

- Transportation and storage

Recent Enforcement: During the January 2025 Los Angeles fires, California extended price gouging protections through July 2025 for hotels and rental housing. Los Angeles prosecutors filed misdemeanor charges against property owners who allegedly raised rental prices beyond legal limits, with potential penalties including one year imprisonment and $10,000 fines.

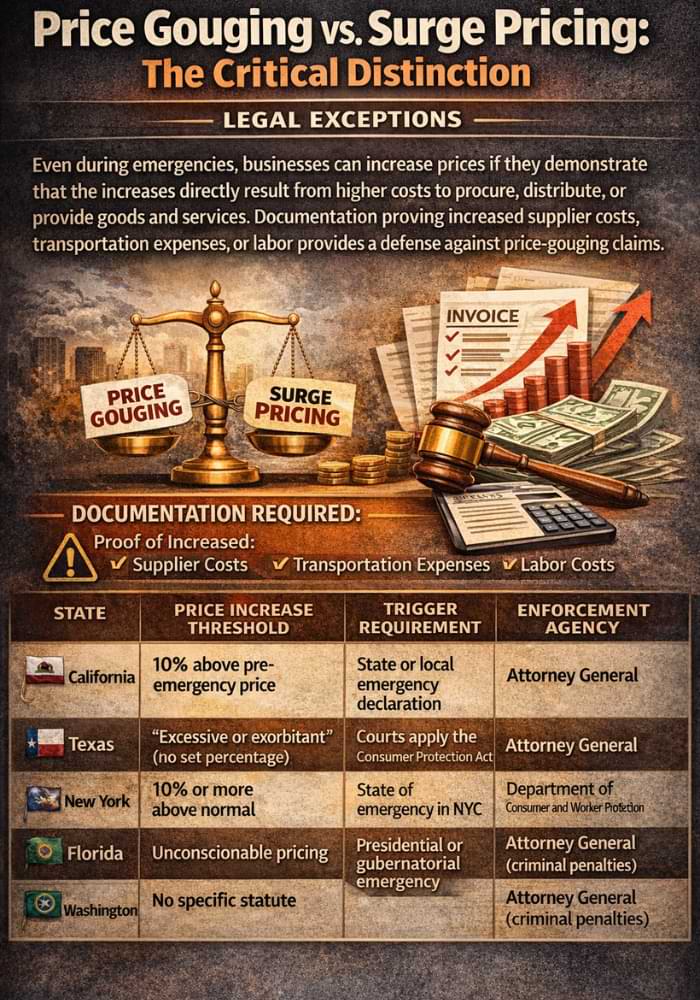

Legal Exceptions

Even during emergencies, businesses can increase prices if they demonstrate that the increases directly result from higher costs to procure, distribute, or provide goods and services. Documentation proving increased supplier costs, transportation expenses, or labor provides a defense against price-gouging claims.

| State | Price Increase Threshold | Trigger Requirement | Enforcement Agency |

| California | 10% above pre-emergency price | State or local emergency declaration | Attorney General |

| Texas | “Excessive or exorbitant” (no set percentage) | Courts apply the Consumer Protection Act | Attorney General |

| New York | 10% or more above normal | State of emergency in NYC | Department of Consumer and Worker Protection |

| Florida | Unconscionable pricing | Presidential or gubernatorial emergency | Attorney General (criminal penalties) |

| Washington | No specific statute | Courts apply Consumer Protection Act | Attorney General |

Industry-Specific Scrutiny

Different sectors face distinct regulatory pressures based on the nature of their products and consumer dependencies.

Grocery Stores: Electronic Shelf Labels

The adoption of electronic shelf labels by major retailers like Kroger and Walmart sparked fears about real-time price surging. Lawmakers, including Senators Elizabeth Warren and Bernie Sanders, raised concerns that stores would charge more during peak shopping times or adverse weather.

However, research from UC San Diego analyzing over 180 million transactions found no evidence of surge pricing. Before electronic labels, one in 20,000 products showed temporary price spikes. After installation, that rate changed by only 0.0006 percentage points.

Grocery economics explain this restraint. Unlike ride-sharing or hotels that monetize single transactions, grocery stores depend on customer loyalty and total basket value. Alienating shoppers with unpredictable price increases would damage long-term profitability.

Despite research findings, Vermont, Arizona, Rhode Island, and Maine have introduced legislation to ban or restrict electronic shelf labels. The debate continues around whether potential future misuse justifies preventing efficiency improvements that reduce food waste.

Online Grocery Delivery: Personalized Pricing

Consumer Reports investigation in late 2025 found Instacart offered approximately 75 percent of checked products at different prices to different customers. Price variations ranged from seven cents to $2.56 per item, with identical grocery baskets differing by up to $9.59.

Following the investigation, Instacart stopped offering technology allowing retailers to charge variable prices. The company had called one tactic “smart rounding” in internal communications.

This demonstrates the tension between personalized discounts and discriminatory pricing. Algorithms cannot distinguish between legitimate price optimization and exploitation without clear rules.

Transportation and Travel

Ride-sharing surge pricing remains legal for normal operations but faces restrictions during emergencies. Several states specifically target surge pricing caps for transportation network companies during disasters or evacuations.

Airlines face Department of Transportation scrutiny following reports that Delta planned algorithmic ticket pricing. Senators questioned whether such systems would harm consumers, prompting agency investigation.

Entertainment and Events

Concert ticket pricing has drawn consumer ire, particularly when platforms use dynamic pricing to capture resale market value. While legal, the practice faces backlash when fans perceive unfair access to cultural events.

Multiple states introduced bills targeting dynamic pricing specifically for entertainment tickets, reflecting public sentiment that essential goods and discretionary purchases deserve different treatment.

Rental Housing: Algorithmic Collusion

The rental housing market received the most aggressive regulatory attention. New York banned algorithmic pricing tools entirely for residential rent in October 2025, prohibiting any software with “coordinating functions” that uses pricing information from multiple landlords.

Over 26 bills across multiple states targeted algorithmic rent-setting, addressing concerns that property management companies using shared software effectively coordinate prices without direct communication. This raises antitrust questions about whether parallel pricing facilitated by common algorithms constitutes illegal collusion.

Consumer Rights and Protections

Understanding your rights helps you identify violations and seek recourse when businesses cross legal boundaries.

Transparency Rights

In states with disclosure laws, you have the right to know when algorithms determine your price using personal data. This information should appear clearly before purchase.

All consumers benefit from price transparency regardless of state law. When you cannot understand why a price changed or why two customers receive different quotes, ask questions and document responses.

Reporting Price Gouging

If you believe you experienced price gouging during an emergency, take these steps:

- Keep all receipts and documentation

- Record the item, price, location, date, and circumstances

- Photograph price displays or advertisements when possible

- Note any declared emergencies in your area

- Report to your state Attorney General’s office

Most states provide online complaint forms. Enforcement actions can result in fines, restitution, and in some cases, criminal charges.

Privacy Protections

State privacy laws like the California Consumer Privacy Act provide some defense against surveillance pricing. You can:

- Request information about what personal data companies collect

- Opt out of data sharing with third parties

- Request deletion of your personal information

- Refuse consent for non-essential data collection

However, these protections have limitations. Companies can still use aggregate data and information from your current session. Opting out of tracking may prevent personalization but not dynamic pricing based on general conditions.

Practical Tip: Use private browsing modes, clear cookies regularly, and compare prices across devices to identify personalized pricing. Significant discrepancies may indicate surveillance pricing practices.

Business Compliance: Operating Within Legal Boundaries

Companies implementing dynamic pricing face evolving compliance requirements. The regulatory patchwork creates challenges, but certain principles apply broadly.

Permissible Dynamic Pricing Practices

Pricing models based on objective market factors remain legal and defensible:

- Time-based pricing reflecting operational costs (peak versus off-peak)

- Supply and demand adjustments apply equally to all customers

- Geographic pricing based on legitimate cost differences

- Promotional discounts and loyalty programs with clear terms

The key is that pricing rules apply universally. Two customers requesting service under identical conditions should receive the same price.

Prohibited Practices

Avoid these high-risk strategies that regulators specifically target:

- Using protected class data (race, age, gender, disability) in pricing decisions

- Tracking individual browsing behavior to predict willingness to pay

- Coordinating prices with competitors through shared algorithmic tools

- Changing prices during emergencies beyond cost-justified increases

- Operating surveillance pricing without required disclosures

Transparency Best Practices

Clear communication prevents consumer confusion and regulatory problems:

- Explain pricing methodology in plain language

- Display factors affecting current prices

- Provide advance notice before implementing new pricing models

- Make disclosure statements prominent, not buried in terms

- Train customer service staff to explain pricing variations

Approaches similar to how pricing tags communicate value and fairness help establish trust. When customers understand pricing logic, they respond more favorably even when prices fluctuate.

Ethical Considerations Beyond Legal Compliance

Legality sets minimum standards. Ethical pricing considers broader impacts on consumer trust, social equity, and market health.

The Fairness Question

Research shows consumers perceive price increases as exploitative when they believe companies have disproportionate power or when customers lack alternatives. This perception intensifies during crises when people depend on essential goods.

Public support for anti-price-gouging laws stems from moral intuitions about fairness rather than economic efficiency. People believe raising prices during emergencies violates implicit social contracts for cooperation and reciprocity.

Businesses should consider whether pricing strategies align with their values and long-term customer relationships. Short-term profit maximization can damage reputation and invite regulation.

Vulnerable Populations

Surveillance pricing and dynamic pricing disproportionately impact consumers with less flexibility:

- Low-income households with rigid shopping schedules

- Rural communities with limited retailer choices

- Seniors and disabled individuals who depend on specific services

- Populations in food deserts with few alternatives

Ethical pricing models account for these disparities. While businesses need not operate as charities, considering accessibility helps prevent practices that society may decide to regulate or ban.

Transparency as an Ethical Imperative

If customers cannot understand your pricing, the pricing model likely needs rethinking. Opaque algorithms that even company employees struggle to explain create information asymmetries that favor businesses at consumer expense.

Former FTC Chair Lina Khan noted we are moving from transparent markets with public prices to opaque worlds where consumers face secret algorithms alone. This shift fundamentally changes market dynamics in ways that may require intervention.

Systems similar to real-time pricing algorithms should be designed with explainability as a core feature, not an afterthought. The goal is pricing that passes the “reasonable explanation test” where you could justify your approach to a skeptical customer or regulator.

Alternative Pricing Models: Building Trust

Some businesses find a competitive advantage in rejecting opaque dynamic pricing in favor of transparent alternatives.

Fixed Pricing with Scheduled Changes

Publishing price lists and updating them on predictable schedules gives customers stability. This works well for essential goods and services where trust matters more than optimization.

Volume Discounts and Loyalty Programs

Rewarding customer loyalty and larger purchases feels fairer than surveillance pricing because customers understand the relationship between their behavior and pricing.

The key difference is transparency and control. Customers choose whether to qualify for discounts rather than unknowingly paying different amounts for identical purchases.

Outcome-Based Pricing

Tying prices to results rather than inputs can align business and customer interests. When customers only pay for successful outcomes, pricing becomes naturally fair.

This model works particularly well in services where value varies. Outcome-based pricing shifts risk to providers and ensures customers receive value proportional to cost.

Cost-Plus Transparency

Some businesses share their cost structure and markup percentage with customers. This radical transparency builds trust by demonstrating fair pricing regardless of what customers might pay.

While not appropriate for every industry, this approach signals commitment to fairness over profit maximization.

Learning from Hidden Tactics: Just as consumers have learned to recognize shrinkflation, where product sizes shrink while prices stay constant, they are becoming savvy to manipulative pricing algorithms. Transparency prevents the backlash that accompanies discovered deception.

The Future of Pricing Regulation

The regulatory landscape will continue evolving as technology enables new pricing capabilities and legislators respond to constituent concerns.

Likely Developments

Expect these trends to shape pricing rules through 2026 and beyond:

- More states are enacting disclosure requirements for algorithmic pricing

- Increased antitrust enforcement against coordinated pricing through shared software

- Sector-specific regulations for essential goods and services

- Federal Trade Commission investigations into surveillance pricing

- Consumer class action lawsuits challenging discriminatory algorithms

Federal Action

While state leadership has dominated, federal agencies signal interest in addressing algorithmic pricing.

The Department of Justice filed statements affirming that antitrust law applies to algorithmic collusion. The Department of Transportation investigates airline algorithmic pricing. The FTC, despite leadership changes, maintains positions that competition enforcement extends to AI-driven pricing.

Federal legislation remains uncertain, but proposed bills like the Price Gouging Prevention Act of 2024 would establish nationwide standards defining excessive pricing during market shocks.

International Comparisons

The European Union, the United Kingdom, and other jurisdictions also scrutinize algorithmic pricing. International coordination between the FTC, European Commission, and UK Competition and Markets Authority suggests global standards may emerge.

Multinational companies face compliance challenges as different regions adopt varying approaches. This may pressure businesses toward more conservative pricing practices that comply with the strictest regulations.

Practical Guidance for Consumers

While regulations protect against the worst abuses, informed consumers can better navigate dynamic pricing environments.

Price Comparison Strategies

- Check prices across multiple devices and browsers

- Compare timing: early morning versus evening prices

- Use private browsing to avoid personalization

- Screenshot prices for documentation

- Join community groups sharing price information

When to Report Concerns

Contact authorities if you observe:

- Extreme price increases during declared emergencies

- Significant price differences between customers for identical products

- Missing disclosures required by state law

- Pricing that appears discriminatory based on protected characteristics

Voting With Your Wallet

Consumer choices shape business behavior. Supporting companies with transparent pricing sends market signals that influence industry practices.

When businesses lose customers over pricing practices, they reconsider strategies. Public criticism and boycotts have prompted policy changes at major companies.

Building Pricing Systems That Last

For businesses considering pricing strategies, sustainability requires balancing immediate revenue with long-term viability.

Regulatory risk is real. Companies investing in surveillance pricing infrastructure face the possibility that states ban the practice entirely. California’s ban on coordinated algorithmic pricing demonstrates that legislatures will restrict practices they consider anticompetitive or exploitative.

Reputational risk may exceed legal risk. Companies face consumer backlash, media scrutiny, and loss of trust even when practices remain technically legal. The costs of defending against criticism and potential lawsuits add up.

The safest path forward involves pricing models that align business success with customer value. When your pricing makes customers feel respected rather than exploited, you build resilience against both regulatory and market challenges.

Understanding principles like price-pack architecture helps structure offerings that customers perceive as fair while maintaining profitability. The goal is to find optimization sweet spots that benefit both parties.

Avoiding common pricing mistakes that alienate customers prevents the regulatory attention that accompanies consumer complaints. Proactive fairness is cheaper than reactive compliance.

Frequently Asked Questions

Is surge pricing legal?

Surge pricing is legal during normal business operations when based on genuine supply and demand factors. It becomes illegal when excessive increases occur during declared emergencies and violate state price gouging laws. The distinction depends on context, transparency, and whether the state has activated emergency protections.

What is surveillance pricing?

Surveillance pricing uses your personal data, including browsing history, location, device type, and purchase patterns to determine how much you will pay. Unlike dynamic pricing based on market conditions, surveillance pricing creates individualized prices targeting what algorithms predict you can afford. Several states now require disclosure or ban this practice entirely.

How do I know if I am being charged more than other customers?

Compare prices across different devices, browsers, and locations. Use private browsing mode and clear cookies between checks. Significant price variations for identical products at the same time suggest personalized pricing. Check whether your state requires disclosure notices about algorithmic pricing.

Can stores use electronic shelf labels to surge prices?

Electronic shelf labels allow real-time price changes, but research found no evidence that grocery stores actually use this capability for surge pricing. Grocers depend on customer loyalty and total basket value, making unpredictable price increases counterproductive. However, some states have introduced legislation restricting the technology over concerns about potential future misuse.

What should I do if I experience price gouging?

Document everything: keep receipts, photograph prices, record dates and locations. Note any declared state of emergency in your area. Report to your state Attorney General’s office through their online complaint system. Most states enforce price gouging laws actively during emergencies and can order restitution for victims.

Are restaurants allowed to use surge pricing?

Restaurants can legally implement time-based pricing charging different amounts during peak versus slow periods, as long as this applies equally to all customers and is clearly communicated. Some states are considering restrictions on restaurant dynamic pricing, but current law generally permits it outside of declared emergencies.

Does dynamic pricing violate antitrust laws?

Dynamic pricing itself does not violate antitrust laws. However, using shared algorithmic pricing tools with competitors to coordinate prices can constitute illegal collusion. California and other states specifically prohibit using common pricing algorithms to restrain trade, even without direct competitor communication.

What is the difference between price gouging and inflation?

Inflation reflects general increases in costs across the economy over time. Price gouging involves sellers raising prices excessively during emergencies to exploit sudden demand without corresponding cost increases. Price gouging laws recognize that businesses may need to pass along higher costs but prohibit profiteering from crises.

Conclusion

Dynamic pricing exists on a spectrum from legitimate business optimization to exploitative practices that lawmakers increasingly restrict. The key dividing lines involve transparency, fairness, and context.

Algorithms that adjust prices based on objective market conditions affecting all customers similarly operate within legal and ethical boundaries. Systems that track individual behavior to extract maximum willingness to pay face growing bans and mandatory disclosures.

Emergency pricing deserves special scrutiny. When disasters strike, profiting from vulnerability crosses moral lines that price gouging laws codify. Business continuity requires building models that regulators and consumers accept as fair.

The regulatory landscape will continue evolving as technology enables new pricing capabilities. Businesses should expect more disclosure requirements, sector-specific restrictions, and antitrust enforcement targeting coordinated pricing.

Ultimately, sustainable pricing strategies align business success with customer satisfaction. Transparency, fairness, and clarity create defensible models that withstand both regulatory scrutiny and market competition.

When customers understand and accept your pricing, you build loyalty that no algorithm can match. That foundation proves more valuable than any short-term gains from opaque optimization.