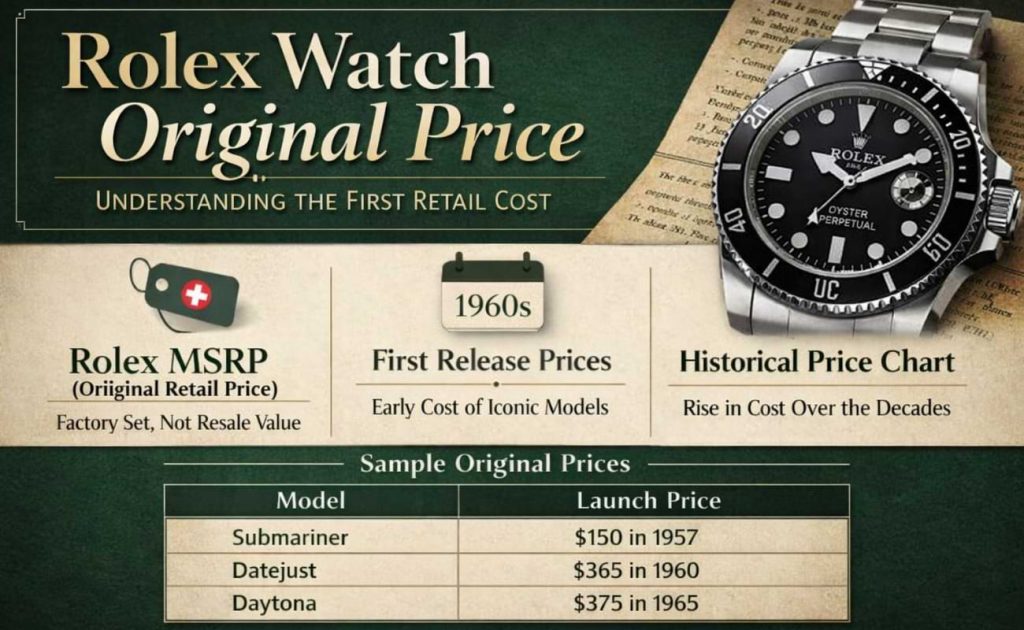

When researching luxury timepieces, understanding the original retail price of Rolex watches provides essential context for collectors, first-time buyers, and market analysts. Unlike current resale values, which often exceed the manufacturer’s suggested retail price (MSRP), original pricing reflects what Rolex SA officially charged through authorized dealers at the time of a model’s release.

This guide examines how Rolex determines official pricing, traces historical price evolution across popular models, and clarifies the distinction between original MSRP and secondary market values.

Rolex Live Price Tracker LIVE

Real-time market price monitoring with automatic daily updates

📊 Select Model to Display

🔄 Auto-Update Active: This chart automatically adds new price data every 24 hours based on market trends. The system checks every minute for new days and simulates realistic market movements. Toggle off to pause automatic updates. Use “Fetch Live Price” to get real-time data via AI web search.

📋 Recent Update History

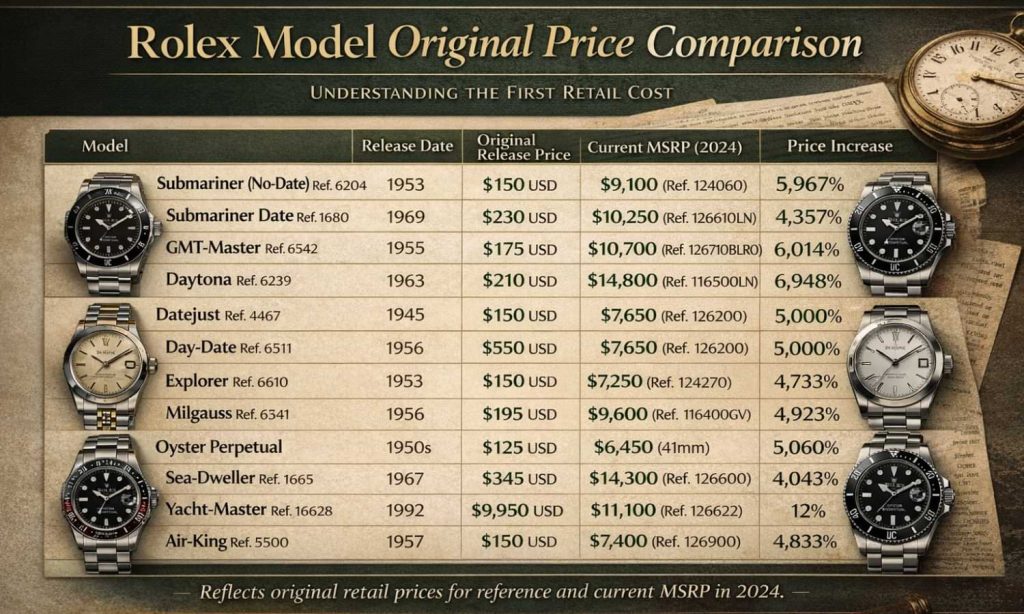

Rolex Model Original Price Comparison

| Model | Release Date | Original Release Price | Current MSRP (2026) | Price Increase |

|---|---|---|---|---|

| Submariner (No-Date) Ref. 6204 | 1953 | $150 USD | $9,100 (Ref. 124060) | 5,967% |

| Submariner Date Ref. 1680 | 1969 | $230 USD | $10,250 (Ref. 126610LN) | 4,357% |

| GMT-Master Ref. 6542 | 1955 | $175 USD | $10,700 (Ref. 126710BLRO) | 6,014% |

| Daytona Ref. 6239 | 1963 | $210 USD | $14,800 (Ref. 116500LN) | 6,948% |

| Datejust Ref. 4467 | 1945 | $150 USD | $7,650 (Ref. 126200) | 5,000% |

| Day-Date Ref. 6511 | 1956 | $550 USD | $38,850 (Ref. 228238) | 6,964% |

| Explorer Ref. 6610 | 1953 | $150 USD | $7,250 (Ref. 124270) | 4,733% |

| Milgauss Ref. 6541 | 1956 | $195 USD | $9,600 (Ref. 116400GV) | 4,823% |

| Oyster Perpetual | 1950s | $125 USD | $6,450 (41mm) | 5,060% |

| Sea-Dweller Ref. 1665 | 1967 | $345 USD | $14,300 (Ref. 126600) | 4,043% |

| Yacht-Master Ref. 16628 | 1992 | $9,950 USD | $11,100 (Ref. 126622) | 12% |

| Air-King Ref. 5500 | 1957 | $150 USD | $7,400 (Ref. 126900) | 4,833% |

Note: Original release prices reflect U.S. market MSRP at time of launch. Current prices represent 2026 MSRP for the closest modern equivalent reference. Percentage increases are nominal and not adjusted for inflation.

How Rolex Determines Official Retail Prices?

Rolex SA, based in Geneva, Switzerland, establishes centralized pricing for its watches distributed through a network of approximately 1,800 authorized dealers worldwide. Several factors influence official retail pricing:

Materials and Components

Rolex manufactures nearly all components in-house, including proprietary movements (calibers), cases, and bracelets. Models featuring precious metals (18k gold, platinum, or Rolesor combinations) command higher MSRPs than stainless steel variants. The brand’s use of 904L stainless steel – more corrosion-resistant than standard 316L – adds manufacturing complexity that influences base pricing.

Movement Complexity

Watches with chronograph functions (Daytona), GMT complications (GMT-Master II), or annual calendars require more intricate calibers. These mechanical movements undergo extensive testing and certification, including COSC chronometer standards and Rolex’s internal Superlative Chronometer testing, which contributes to the pricing structure.

Production Volume and Market Positioning

Rolex does not publish production figures, but industry analysts estimate annual output between 800,000 to 1,000,000 watches. The brand maintains premium positioning through controlled distribution rather than artificial scarcity, which supports stable MSRP increases over time rather than volatile pricing.

Currency and Regional Adjustments

Official prices vary by market based on local currency, import duties, and VAT/sales tax structures. A Submariner with identical specifications may have different MSRPs in Switzerland, the United States, and Japan when adjusted for local regulations.

Historical Evolution of Rolex Original Prices

Tracking Rolex’s original prices across decades reveals a gradual appreciation aligned with material costs, technological improvements, and luxury market positioning.

Price Progression by Era

| Era | Representative Model | Approximate Original Price | Notable Context |

|---|---|---|---|

| 1950s | Submariner Ref. 6204 | $150 USD | Early professional dive watch introduction |

| 1960s | Datejust Ref. 1601 | $250-$350 USD | Depending on dial and bracelet configuration |

| 1970s | Daytona Ref. 6263 | $500-$700 USD | Manual-wind chronograph, Valjoux movement |

| 1980s | Submariner Ref. 16800 | $1,500-$2,000 USD | Introduction of sapphire crystal |

| 1990s | Submariner Date Ref. 16610 | $3,000-$3,500 USD | Long-production reference |

| 2000s | Submariner Date Ref. 116610LN | $6,000-$6,500 USD | Ceramic bezel introduction |

| 2010s | Submariner Date Ref. 116610LN | $8,550 USD (2019) | Pre-pandemic pricing |

| 2020s | Submariner Date Ref. 126610LN | $9,150 USD (2020 launch) | New movement and case design |

Important Note: Early historical prices vary significantly by source, market, and exact year. Documentation from authorized dealers in the 1950s-1970s is limited, and figures reflect the best available research from vintage catalogs, dealer records, and horological archives. Prices shown exclude taxes and represent U.S. market MSRP where documented.

Why Historical Prices Differ Across Sources

Collectors researching original Rolex prices often encounter conflicting figures. Several factors explain these discrepancies:

- Market-Specific Pricing: A Datejust sold in Switzerland had a different MSRP than one sold in the United States during the same year.

- Configuration Variations: Dial colors, bracelet types (Oyster vs. Jubilee), and bezel materials created price tiers within the same reference number.

- Exchange Rate Fluctuations: Currency conversion at the time of sale versus modern USD conversions produces different values.

- Incomplete Documentation: Rolex does not maintain a public archive of historical retail prices; researchers rely on dealer receipts, period advertisements, and collector documentation.

Transparency about these limitations is essential for accurate market research. Claims of “exact” original prices for vintage references should be approached with healthy skepticism unless supported by period documentation.

Model-Specific Original Pricing Analysis

Understanding original MSRP by model family helps buyers contextualize current market conditions and value propositions.

Oyster Perpetual Collection

The entry-level Oyster Perpetual serves as Rolex’s most accessible model, featuring time-only complications in various case sizes.

Current Generation (2024-2026):

- Oyster Perpetual 36mm: $6,100 USD MSRP

- Oyster Perpetual 41mm: $6,450 USD MSRP

The Oyster Perpetual’s original pricing positions it as the gateway to the Rolex ecosystem, typically $2,000-$3,000 below comparable Datejust models.

Submariner and Submariner Date

Rolex’s flagship dive watch commands premium pricing based on professional functionality, ceramic bezel technology, and cultural cachet.

Current Generation (2020-2026):

- Submariner No-Date Ref. 124060: $9,100 USD

- Submariner Date Ref. 126610LN: $10,250 USD

- Submariner Date Ref. 126610LV (“Hulk” successor): $10,800 USD

The Submariner Date consistently maintains approximately a $1,000-$1,500 premium over the no-date variant, reflecting the added complication and cyclops lens.

GMT-Master II

Designed for pilots and frequent travelers, the GMT-Master II features a 24-hour complication and rotating bezel for tracking multiple time zones.

Current Generation (2018-2026):

- GMT-Master II Ref. 126710BLNR (Jubilee bracelet): $10,700 USD

- GMT-Master II Ref. 126710BLRO (Oyster bracelet): $10,700 USD

- GMT-Master II Ref. 126720VTNR (left-handed): $10,900 USD

GMT models typically position $500-$1,000 above comparable Submariner Date references, reflecting mechanical complexity.

Daytona

The Cosmograph Daytona, Rolex’s chronograph offering, represents the brand’s highest-demand steel sports model.

Current Generation (2016-2026):

- Daytona Ref. 116500LN (white dial): $14,800 USD

- Daytona Ref. 116500LN (black dial): $14,800 USD

Despite identical MSRP, secondary market demand creates substantial pricing premiums, particularly for the white “Panda” dial variant. This disconnect between original price and market reality exemplifies supply-demand dynamics in luxury watches.

Datejust

Rolex’s quintessential dress watch, available in numerous configurations, creates a broad pricing spectrum based on materials and complications.

Current Generation (2024-2026):

- Datejust 36mm (steel Oyster bracelet): $7,650 USD

- Datejust 36mm (steel Jubilee bracelet): $8,100 USD

- Datejust 41mm (steel Oyster bracelet): $8,050 USD

- Datejust 41mm (Rolesor two-tone): $11,200-$13,500 USD

- Datejust 41mm (18k yellow gold): $37,000+ USD

Material choice creates the most significant price variation within the Datejust family, with gold models commanding 4-5x the MSRP of stainless steel variants.

Day-Date

The Day-Date, available exclusively in precious metals, represents Rolex’s prestige flagship.

Current Generation (2024-2026):

- Day-Date 36mm (18k yellow gold): $37,500 USD

- Day-Date 40mm (18k yellow gold): $38,850 USD

- Day-Date 40mm (platinum): $61,500 USD

Day-Date original pricing reflects both material value and cultural significance as the “President’s watch.”

Original MSRP vs. Current Market Prices: Understanding the Gap

One of the most common misconceptions among prospective Rolex buyers involves confusing the original retail price with the current market value. These represent fundamentally different concepts.

What Original Price Represents

Original retail price (MSRP) reflects what Rolex SA and its authorized dealer network charged at the point of sale. This figure remains fixed for a specific reference during its production run, with periodic updates announced by Rolex typically once per year. For example, the Submariner Date Ref. 126610LN launched at $9,150 USD in September 2020 and has since increased to $10,250 USD through incremental MSRP adjustments.

What Market Price Represents

Market price reflects what buyers pay through secondary channels: gray market dealers, private sales, auction houses, and online marketplaces. These prices fluctuate based on:

- Demand relative to supply: Models with multi-year waitlists at authorized dealers (Daytona, certain GMT-Master II variants) trade at significant premiums.

- Discontinued status: References no longer in production often appreciate, particularly if they represent design milestones.

- Condition and provenance: Unworn examples with complete documentation command higher premiums than pre-owned watches.

- Market sentiment: Broader luxury goods trends, economic conditions, and collector enthusiasm influence pricing.

The Premium Paradox

As of 2025-2026, numerous Rolex models trade 50-100% above MSRP in secondary markets:

- Daytona Ref. 116500LN: $14,800 MSRP → $30,000-$35,000 market price

- GMT-Master II Ref. 126710BLNR: $10,700 MSRP → $17,000-$20,000 market price

- Submariner Date Ref. 126610LN: $10,250 MSRP → $15,000-$17,000 market price

This disconnect exists because authorized dealer allocation cannot meet market demand. Buyers willing to pay premiums can access watches immediately rather than waiting months or years for authorized dealer availability.

Why This Matters for Research

When evaluating Rolex pricing data, distinguishing original from market price prevents several analytical errors:

- Overestimating accessibility: MSRP suggests affordability that may not reflect real-world purchasing reality.

- Misunderstanding value retention: A watch trading above MSRP may reflect market dynamics rather than the timepiece’s intrinsic appreciation.

- Investment fallacies: Secondary market premiums can contract rapidly if demand shifts or supply increases.

For collectors focused on long-term value, original MSRP provides a more stable baseline than volatile secondary prices influenced by temporary market conditions.

Why Original Price Knowledge Matters for Buyers?

Understanding Rolex’s original pricing serves multiple practical purposes beyond academic interest.

Evaluating Long-Term Value

Original MSRP helps buyers assess whether current market premiums reflect sustainable appreciation or temporary speculation. A watch trading at 2x MSRP may normalize if Rolex increases production or market enthusiasm wanes. Conversely, discontinued references with historically stable premiums demonstrate more reliable value retention.

Negotiating Secondary Purchases

Buyers armed with MSRP knowledge can better evaluate dealer offers. A used Submariner Date priced at $16,000 (60% above current $10,250 MSRP) may be fair given current market conditions, but the buyer understands they’re paying a significant premium over what an authorized dealer charges – if allocation were available.

Identifying Overpriced Listings

Original price knowledge helps buyers spot inflated listings. If a current-production model commands 3x MSRP without extraordinary provenance (celebrity ownership, unique dial variation), the premium likely exceeds market norms.

Setting Realistic Expectations

First-time Rolex buyers often underestimate the total acquisition cost. A Submariner’s $10,250 MSRP becomes $15,000-$17,000 through secondary channels, plus potential sales tax. Original pricing clarifies the true entry point for specific models.

Avoiding Investment Pitfalls

Original MSRP data helps buyers approach Rolex purchases as luxury goods rather than financial assets. While certain references have appreciated significantly over the decades, using original price as an investment baseline without considering opportunity cost, maintenance expenses, and market risks leads to flawed financial decisions.

Common Misconceptions About Rolex Pricing

“Rolex Raises Prices Every Year”

While Rolex does implement annual price adjustments, these typically range 3-6% and reflect inflation, material costs, and currency fluctuations. The brand has maintained relatively consistent real-dollar pricing adjusted for inflation over multi-decade periods. For example, the Submariner’s price-to-wages ratio has remained fairly stable when adjusted for average income growth.

“All Rolex Watches Appreciate in Value”

Original purchase price does not guarantee appreciation. Many Datejust and Oyster Perpetual references trade below MSRP in secondary markets, particularly those in common configurations without precious metals. Appreciation depends on model scarcity, condition, and collector demand – not original price alone.

“Gray Market Dealers Offer ‘Discounts'”

Authorized dealers sell at the published MSRP. So-called discounts from gray market sources typically involve watches purchased in markets with lower local MSRP (due to currency or tax differences) and resold in higher-priced markets. These are arbitrage opportunities, not manufacturer discounts.

“Original Price = Fair Resale Price”

A watch’s original MSRP provides context but does not determine fair resale value. Discontinued references often trade above their original price, even accounting for inflation, while current production models in low demand may trade below MSRP. Fair resale price reflects current supply-demand dynamics, not historical retail figures.

Frequently Asked Questions

What is a Rolex original price?

A Rolex original price refers to the manufacturer’s suggested retail price (MSRP) charged by authorized dealers at the time of a watch’s release or during its production run. This differs from secondary market prices, which fluctuate based on supply and demand.

Are Rolex prices the same worldwide?

No. Rolex sets market-specific pricing based on local currency, import duties, and tax structures. The same model may have different MSRPs in Switzerland, the United States, Japan, and other markets when adjusted for these factors.

Does Rolex publish historical prices?

Rolex does not maintain a public archive of historical retail prices. Researchers rely on authorized dealer receipts, period advertisements, collector documentation, and vintage catalogs to reconstruct original pricing across decades.

Why do some Rolex watches cost more than their original price?

Current market prices often exceed MSRP for high-demand models due to limited authorized dealer availability. Buyers paying above MSRP can access watches immediately rather than waiting months or years for allocation from authorized dealers.

How often does Rolex increase prices?

Rolex typically adjusts MSRP annually, with increases ranging 3-6% reflecting inflation, material costs, and currency fluctuations. The exact timing varies by market and is communicated through authorized dealer networks.

Can I buy a Rolex at the original price?

Purchasing at MSRP requires establishing a relationship with an authorized dealer and potentially joining waitlists for high-demand models. For readily available references like certain Datejust configurations, MSRP purchases remain accessible.

What was the original price of vintage Rolex watches?

Early Rolex models from the 1950s-1970s had original prices ranging from $150-$700 USD, depending on model and era. However, exact figures vary by source due to limited documentation and regional pricing differences.

Do precious metal Rolex watches hold value better?

Not necessarily. While gold and platinum models have higher MSRPs, they also carry intrinsic metal value that can fluctuate. Some stainless steel sports models have demonstrated a stronger percentage appreciation over time compared to precious metal variants.

About This Research

This analysis was prepared by Original Pricing, a platform dedicated to historical pricing research and market analysis across luxury goods and consumer products. Our methodology emphasizes transparency, source verification, and clear distinction between manufacturer pricing and secondary market dynamics.

Research Approach: We compile pricing data from dealer archives, period publications, auction records, and collector documentation. Where historical data has gaps or conflicts, we acknowledge these limitations rather than presenting speculative figures as fact.

Content Integrity: All pricing research serves educational purposes and should not be interpreted as financial advice or investment guidance. Luxury watch purchases involve personal preference, condition assessment, and market timing that extend beyond historical price analysis.