Last Updated: February 2026 | Research by OriginalPricing.com

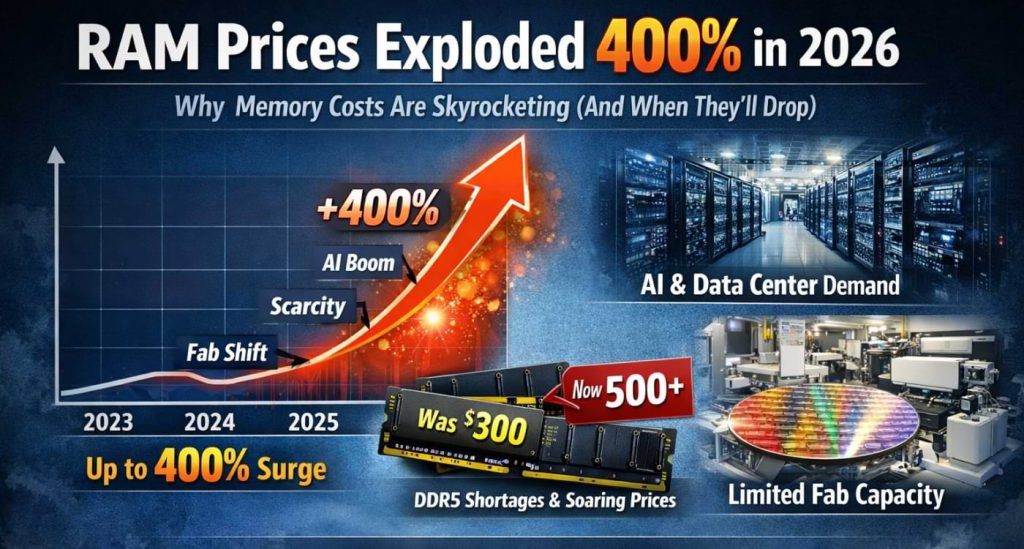

Key Takeaway: RAM prices have exploded in late 2025 and early 2026, with some memory kits increasing by 300-500% in just a few months. A 32GB DDR5 kit that cost $90-120 in spring 2025 now routinely sells for $300-450, and experts warn prices will continue rising through mid-2026 before any relief arrives.

If you’ve recently shopped for computer memory or considered a PC upgrade, you’ve likely experienced sticker shock. The RAM market is experiencing an unprecedented pricing crisis that’s reshaping the entire consumer electronics landscape. What was once one of the most affordable and stable PC components has transformed into a volatile cost driver affecting everything from gaming PCs to laptops, smartphones, and even gaming consoles.

This comprehensive analysis examines the forces behind the 2026 RAM pricing crisis, provides historical price context across different memory types, and offers practical guidance for navigating this challenging market.

🔴 Live RAM Price Tracker 2026

Real-time memory pricing with automatic daily updates

| Memory Type | Current Price | Yesterday | Change ($) | Change (%) | 7-Day Trend |

|---|---|---|---|---|---|

| Loading data… | |||||

Understanding the Scale of the Crisis

The memory pricing situation in 2026 represents more than typical market fluctuation; it’s a structural shift driven by fundamental changes in global semiconductor manufacturing priorities.

Price Comparison: 2025 vs 2026

To understand the severity of the crisis, here’s how RAM prices have changed from 2025 to 2026:

| Memory Type | 2025 Price | 2026 Price | Change |

|---|---|---|---|

| DDR5 32GB Kit | $90-120 | $310-450 | +300-400% |

| DDR5 64GB Kit | $180-210 | $710-750 | +294-357% |

| DDR5 128GB Kit | $400-500 | $1,000-1,200 | +140-200% |

| DDR4 32GB Kit | $60-90 | $150-200 | +150-233% |

| DDR4 64GB Kit | $120-180 | $350-470 | +161-292% |

| DDR4 256GB Kit | $800-1,000 | $3,000+ | +200-275% |

Price data compiled from multiple retail sources. For more pricing research, visit OriginalPricing.com.

Real-World Impact: In some extreme cases, a 64GB RAM module now costs more than an entire PlayStation 5 console. Framework, a modular laptop manufacturer, raised its 48GB RAM upgrade price from $250 in June 2025 to $620 by December 2025,a 148% increase in just six months.

Week-to-Week Volatility

Unlike traditional commodity pricing, where changes occur gradually, RAM prices in 2026 are exhibiting stock market-like volatility. Retailers and system builders report that contract prices from manufacturers can double within a single month, with some suppliers providing only hours to accept or decline purchase orders.

Memory manufacturers like TeamGroup have confirmed that December 2025 contract prices for certain DRAM and NAND categories increased 80-100% month-over-month, creating unprecedented uncertainty for both consumers and businesses planning PC purchases.

The Root Causes: Why Is RAM So Expensive in 2026?

The 2026 RAM crisis isn’t caused by a single factor but rather a perfect storm of supply and demand dynamics reshaping the global semiconductor industry.

1. The AI Revolution’s Insatiable Memory Appetite

The primary driver behind skyrocketing RAM prices is the explosive demand for memory from the artificial intelligence sector, particularly for training and running large language models and other AI workloads.

High Bandwidth Memory (HBM) Production Shift:

- Capacity Reallocation: The world’s “Big Three” memory manufacturers, Samsung, SK Hynix, and Micron (who collectively control approximately 95% of global DRAM production) have massively reallocated manufacturing capacity toward High Bandwidth Memory (HBM) used in AI accelerators and GPUs.

- Production Tradeoff: Manufacturing one unit of HBM memory requires approximately 3x the wafer capacity of standard DDR5 RAM. When Micron produces one bit of HBM memory, it must forgo making three bits of conventional consumer RAM.

- AI’s Market Share: Industry projections indicate that AI-related memory products will account for approximately 20% of global wafer capacity by 2026, up from minimal levels just two years earlier.

- Contract Commitments: Major tech companies, including Google, Amazon, Microsoft, and Meta, have placed open-ended orders with memory suppliers, essentially agreeing to purchase as much supply as available regardless of cost, according to Reuters sources.

OpenAI’s partnership announcement with Samsung and SK Hynix revealed plans to target 900,000 DRAM wafer starts per month, representing approximately 40% of total global DRAM output. This unprecedented demand is fundamentally reshaping manufacturing priorities.

2. Deliberate DDR4 Phase-Out Creating Artificial Scarcity

Memory manufacturers are actively phasing out DDR4 production to force market transition to DDR5, creating a “programmed scarcity” scenario:

- Production Cuts: Samsung announced it would halt production of 8Gb DDR4 chips by April 2025, with final DDR4 module shipments by December 2025. By 2026, DDR4 production will have dropped to approximately 20% of 2025 levels.

- Micron’s Exit: In a shocking move, Micron announced the closure of its consumer-focused memory line, Crucial, preferring to sell products directly to AI companies to maximize profits rather than serve the retail market.

- Price Inversion: This created a paradoxical situation where older DDR4 memory sometimes costs more than superior DDR5 modules due to scarcity, despite DDR5’s technical advantages.

Industry Strategy: By choking off DDR4 supply, manufacturers accomplish two objectives: they free up fabrication lines to produce more profitable DDR5 and HBM products, and they force the market to adopt DDR5 more quickly by making DDR4 unavailable or prohibitively expensive.

3. Post-Oversupply Market Correction

Following a severe market downturn in 2022-2023, where memory manufacturers experienced significant losses due to oversupply, companies implemented strategic production cuts to stabilize pricing. When AI demand suddenly surged in mid-2024, the industry lacked the capacity to respond quickly.

Building new semiconductor fabrication facilities (fabs) typically requires 3-5 years and multi-billion-dollar investments. The supply chain cannot rapidly adjust to meet current demand, creating the perfect conditions for sustained price escalation.

4. Consumer Demand Evolution

Ironically, consumer demand patterns are also contributing to the shortage:

- AI PC Requirements: Microsoft’s Copilot+ PCs require a minimum of 16GB RAM, with many systems now shipping with 32GB or more to support on-device AI features.

- Local AI Models: The growing adoption of local large language models (LLMs) in late 2025 has fundamentally altered consumer memory requirements. Running efficient models like Llama-4 or Mistral-Local requires substantial memory overhead, transforming 64GB or 96GB of system RAM from a niche requirement into standard equipment for prosumers and developers.

- Gaming Requirements: Modern games and creative applications increasingly require larger memory capacities, driving demand for higher-capacity kits.

DDR4 vs. DDR5: Which Is More Affected?

Both memory technologies are experiencing dramatic price increases, but for different reasons:

DDR5 Price Dynamics

DDR5, the newer memory standard, has seen prices surge by 400-500% since early 2025. However, DDR5 remains the more future-proof choice:

- Market Position: DDR5 adoption has accelerated to 45-50% of the market, driven by new Intel and AMD platforms requiring DDR5.

- Production Priority: While expensive, DDR5 production continues as manufacturers prioritize it over legacy DDR4.

- Technical Advantages: DDR5 offers approximately 30% better power efficiency and significantly higher speeds (6000+ MT/s becoming standard).

- Long-term Value: Despite high current prices, DDR5 provides better long-term platform compatibility and upgrade paths.

DDR4 Price Dynamics

DDR4 started in 2025 as a budget-friendly option but experienced explosive price hikes due to end-of-life production cuts:

- Supply Contraction: With major manufacturers cutting production, DDR4 availability has become severely constrained.

- Legacy Demand: Massive installed base of legacy platforms (Intel 10th-12th Gen, AMD AM4, industrial and embedded systems) still requires DDR4.

- Price Increases: While DDR4 increases have been more moderate (150-200% versus DDR5’s 400-500%), the scarcity makes DDR4 increasingly difficult to source.

- Future Outlook: DDR4 will become a niche, expensive legacy product with limited availability throughout 2026.

| Factor | DDR4 | DDR5 |

|---|---|---|

| Price Increase Since 2025 | 150-200% | 400-500% |

| Availability | Severely Constrained | Tight but Available |

| Production Trend | Declining Rapidly | Stable/Growing |

| Best For | Existing Legacy Systems Only | New Builds & Long-term Use |

| 2026 Outlook | Continued Scarcity | High Prices, Better Availability |

Market Impact: Beyond Just PC Builders

The RAM pricing crisis extends far beyond DIY PC builders, affecting virtually every sector of consumer electronics and enterprise computing.

Consumer Electronics Pricing

Laptops and Pre-built PCs:

- Major vendors, including Dell, Lenovo, HP, Acer, and ASUS, have announced 15-20% price increases effective in the second half of 2026.

- Memory now represents approximately 20-25% of the bill of materials for a mid-range laptop, up from 10-18% in early 2025.

- The International Data Corporation (IDC) projects PC average selling prices could rise by 6-8% in pessimistic scenarios.

Smartphones:

- Memory represents 15-20% of the total smartphone bill of materials for mid-range devices and 10-15% for flagships.

- Chinese OEMs like Xiaomi, Oppo, Vivo, Honor, and Huawei, operating on thin margins, face the most severe pressure and are likely to pass costs to consumers.

- Some manufacturers are implementing “shrinkflation,” quietly downgrading specifications (reducing from 12GB+512GB to 8GB+256GB configurations) to maintain price points.

- IDC warns of a potential 5% smartphone market contraction in 2026 in pessimistic scenarios.

Gaming Consoles:

- Console manufacturers face a strategic dilemma between absorbing costs (eroding already-thin hardware margins) or raising prices (risking demand destruction).

- Industry speculation suggests Sony and Microsoft may delay next-generation consoles to 2029-2030, waiting for capacity normalization rather than launching into constrained supply.

Graphics Cards:

- The crisis extends to GDDR memory used in GPUs, with Nvidia reportedly reducing GPU production by 30-40% in the first half of 2026 due to VRAM limitations.

- Higher VRAM configurations will command significant price premiums, making rumored RTX 50 Super graphics cards with higher video memory particularly expensive.

PC Market Outlook

IDC’s updated forecast reveals the severity of the situation:

- Moderate Scenario: 4.9% PC market contraction in 2026 (versus the previous forecast of 2.4% decline).

- Pessimistic Scenario: Up to 8.9% market contraction, approaching the severity of the 2009 financial crisis (11.9% decline) and post-pandemic saturation (nearly 15% drop).

- Terrible Timing: This decline occurs when the market should be booming due to the Windows 10 end-of-life refresh cycle and AI PC adoption.

The memory shortage is simultaneously colliding with two major industry forces: the Windows 10 support cliff driving enterprise refresh cycles, and the push toward “AI PCs” requiring more memory. This creates a paradox where devices need more RAM precisely when RAM has become prohibitively expensive.

When Will RAM Prices Drop? Expert Forecasts and Timeline

The consensus among industry analysts is sobering: significant relief is unlikely before late 2027, with some experts projecting sustained elevated pricing through 2028.

Short-Term Outlook (Q1-Q2 – 2026)

- Continued Escalation: Industry analysts and manufacturers predict DRAM and NAND chip prices will continue rising throughout the first half of 2026.

- Peak Pricing: Multiple sources indicate peak pricing will occur around mid-2026, with some forecasting DDR5 prices could rise an additional 45-60% in Q1 2026 alone.

- Supply Exhaustion: TeamGroup’s general manager warns that once distribution stockpiles are exhausted in Q1-Q2 2026, obtaining allocation could become difficult regardless of willingness to pay.

- Stockpile Depletion: Long-term contracts with memory manufacturers are continuing to fulfill, which could result in consumer stockpiles running completely dry by early 2026 if demand remains high.

Medium-Term Outlook (H2 2026 – 2027)

- Limited Relief: Some analysts project DDR5 prices could decline by 20-30% from December 2025 peaks in mid-2026, though prices are unlikely to return to pre-2024 levels.

- New Normal: Instead of returning to sub-$100 levels for 32GB DDR5 kits, expect a “new normal” stabilization point around $100-120 in late 2026 at the earliest.

- Continued Volatility: Week-to-week price fluctuations are expected to continue as the market remains in a seller’s market with manufacturers prioritizing strategic clients.

Long-Term Outlook (2027-2028+)

Supply normalization depends on two potential scenarios:

Scenario 1: New Production Capacity Comes Online

- Micron’s US Investments: Micron has announced a $200 billion US investment commitment, with new fabs in Boise, Idaho, expected to start producing memory in 2027 and 2028, and a Clay, New York facility expected to be online by 2030.

- SK Hynix Expansion: SK Hynix’s Yongin cluster is expected to reach volume production by late 2027.

- Samsung Capacity: Samsung plans a 50% HBM capacity surge in 2026, though this continues to prioritize AI memory over consumer products.

- Timeline Reality: Building new greenfield fabrication facilities typically takes 3-5 years, meaning meaningful capacity additions won’t arrive until 2027 at the earliest, with more significant relief likely in 2028.

Scenario 2: AI Demand Moderates (The “AI Bubble Bursts”)

- If the AI boom cools significantly, manufacturers could redirect capacity back to consumer DRAM, potentially creating rapid price corrections.

- Some analysts consider this less likely in the near term, given the fundamental transformation AI is driving across industries.

- A potential oversupply scenario in 2028-2029 remains possible if AI demand moderates as new capacity expands.

Industry Consensus: Supply normalization is unlikely before late 2027 to 2028 when more production capacity emerges. SK Hynix, a major memory manufacturer, has indicated that RAM shortages will last until 2028, suggesting consumers should prepare for sustained high prices throughout 2026 and into 2027.

Storage (SSD) Pricing: Will SSDs Face the Same Crisis?

Many consumers wonder whether solid-state drives will experience similar price explosions. The situation is nuanced:

Current SSD Market Status

Less Severe Impact (For Now):

- NAND-based storage pricing shows far less movement than DRAM, though increases are occurring.

- SSDs and RAM use different manufacturing technologies (NAND Flash vs. DRAM), with distinct production lines.

- The current shortage is specifically driven by reallocation of DRAM lines to HBM for AI GPUs, with NAND production remaining relatively stable.

Emerging Concerns:

- NAND memory costs, which account for 90% of an SSD’s cost structure, have risen 246% since Q1 2025, according to Kingston.

- Manufacturers like SanDisk have announced plans to double the prices of 3D NAND for enterprise SSDs in Q1 2026.

- NAND suppliers are also prioritizing large customers (AI server makers) over consumer markets.

- The price of a 1 Terabit TLC NAND jumped from $4.80 in July 2025 to $10.70 in November 2025, a 123% increase in under six months.

Expert Predictions:

- Kingston representatives warn that SSD prices are expected to rise in 2026, though not to the same extreme degree as RAM.

- TeamGroup’s general manager indicates NAND suppliers don’t expect capacity to swing back to consumer devices in 2026.

- While not experiencing the same crisis severity as DRAM, SSD prices are trending upward and may see 20-40% increases through 2026.

What Should Consumers Do? Strategic Buying Guidance

Navigating the 2026 RAM crisis requires strategic thinking about timing, priorities, and long-term planning.

If You Need Memory Now

Buy Sooner Rather Than Later:

- The consensus among industry experts is clear: if you need memory now, don’t wait. Kingston representatives and multiple analysts recommend purchasing immediately as prices are expected to continue rising through mid-2026.

- Holiday inventory clearances in late 2025 and early 2026 may represent the last opportunity for relatively reasonable pricing before new contracts kick in.

- If you’re planning a system build or upgrade, consider purchasing RAM ahead of other components to lock in current pricing.

Prioritize DDR5 for New Builds:

- Despite higher prices, DDR5 offers better long-term value with superior performance, efficiency, and platform longevity.

- DDR4 will continue to become scarcer and may eventually cost more than DDR5 due to production cuts.

- Modern platforms from Intel (12th gen+) and AMD (AM5) are designed around DDR5, making it the better investment for longevity.

Consider Pre-Built Systems:

- Large manufacturers with advanced contracts and bulk purchasing power may offer better value than building from components.

- It is now often cheaper to buy a pre-built gaming PC than to build one yourself due to component manufacturers’ pricing power versus OEM contracts.

- However, verify the memory specifications carefully, as some manufacturers may quietly downgrade specs to maintain price points.

If You Can Wait

Assess Your Current System:

- If your system is still performing adequately for your needs, delaying upgrades until late 2027 or 2028 may be the most cost-effective strategy.

- Consider whether your current RAM capacity truly limits your use cases, or if storage, CPU, or GPU upgrades would provide more value.

- For gaming specifically, many titles still perform well with 16GB of RAM, and GPU upgrades often provide more noticeable improvements than memory increases.

Consider Alternative Upgrade Paths:

- If possible, extend your current platform’s life through other upgrades (better CPU cooler, additional storage, GPU upgrade).

- For DDR4 systems, consider maximizing your current platform before switching to DDR5 when prices normalize.

- Some users may find that upgrading other components provides better value-for-money than expensive memory upgrades.

For Business and Enterprise

Strategic Procurement Planning:

- Rethink Budgeting: RAM in 2026 is no longer a stable standard item but a volatile cost driver requiring price buffers and alternative scenarios.

- Leverage DDR4 Infrastructure: Where technically feasible, expanding existing DDR4 systems may be more economical than immediate DDR5 transitions.

- Phase Expansions: Divide large RAM upgrade projects into stages, implement sensible baseline configurations first, with expansions planned when budget and market conditions improve.

- Lock in Contracts: For planned purchases, securing fixed-price contracts now may provide protection against further price increases.

- Build Strategic Inventory: Organizations with the capital may benefit from purchasing planned 2026 memory needs in advance, though this requires careful cash flow management.

Avoid These Common Mistakes

- Don’t Wait for “The Perfect Moment”: Market timing is extremely difficult with current volatility, and waiting could mean paying significantly more.

- Don’t Overbuy Capacity You Don’t Need: While prices are high, buying 128GB when 32GB meets your needs wastes money that could be saved or invested elsewhere.

- Don’t Fall for Scalper Pricing: Verify prices against multiple reputable retailers and avoid obviously inflated scalper pricing on marketplaces.

- Don’t Assume Prices Will Crash Soon: With consensus forecasts pointing to late 2027-2028 for normalization, banking on imminent price crashes is risky.

Historical Context: How Does 2026 Compare to Past Memory Crises?

The RAM industry has experienced several notable price fluctuations over the past two decades, but the 2026 crisis is unique in both magnitude and underlying causes.

The 2016-2018 DRAM Shortage

- Causes: Transition to smaller process nodes, increased smartphone adoption, and cryptocurrency mining driving GPU demand.

- Price Impact: DDR4 prices roughly doubled over 18 months.

- Duration: Approximately 2 years before normalization.

- Resolution: Increased production capacity and market correction as demand moderated.

The 2020-2021 Pandemic Supply Chain Crisis

- Causes: COVID-19 disruptions, work-from-home demand surge, and automotive chip shortages.

- Price Impact: Moderate increases (30-60%) across most components.

- Duration: Approximately 18 months with gradual recovery.

- Resolution: Supply chain adaptation, demand normalization, and increased production.

The 2022-2023 Market Crash

- Causes: Post-pandemic demand collapse, cryptocurrency mining crash, oversupply.

- Price Impact: Massive price declines, some memory at historic lows.

- Duration: Approximately 12-18 months.

- Outcome: Set the stage for the current crisis as manufacturers cut production dramatically to avoid losses.

The 2025-2028 AI-Driven Crisis (Current)

- Causes: Structural reallocation to HBM for AI, deliberate DDR4 phase-out, and new consumer requirements.

- Price Impact: Unprecedented 300-500% increases in under 12 months.

- Projected Duration: 2-3 years (late 2025 through late 2027 or 2028).

- Unique Factor: Unlike previous shortages driven by temporary disruptions, this represents a fundamental market restructuring prioritizing high-margin AI products over consumer memory.

Historical Perspective: The current crisis is more severe and longer-lasting than previous memory shortages because it stems from deliberate, structural changes in the semiconductor industry rather than temporary disruptions. The shift toward AI infrastructure represents a permanent reordering of manufacturing priorities, not a cyclical supply-demand imbalance that will self-correct quickly.

Global Market Variations: Regional Price Differences

The RAM crisis affects different regions with varying intensity based on local market dynamics, currency fluctuations, and distribution channels.

North America (United States & Canada)

- Availability: Generally better than other regions due to direct manufacturer relationships and large market size.

- Price Premium: Moderate, though still experiencing the full force of price increases.

- Retailer Response: Major retailers like Newegg, Amazon, and Best Buy are seeing rapid stock turnover with frequent price adjustments.

Europe

- Availability: Tighter than North America, with longer delivery times.

- Price Premium: Higher due to VAT, import duties, and distribution costs.

- Regional Variations: Western European markets (Germany, UK, France) have better availability than Eastern Europe.

- Currency Impact: Euro and British Pound fluctuations are affecting relative pricing.

Asia-Pacific

- Japan: Tokyo’s Akihabara electronics district has implemented purchase limits on memory products to prevent hoarding, with prices more than doubling for popular configurations.

- China: Domestic manufacturer CXMT is increasing its market share, which provides some buffer, though still experiencing significant price increases.

- Southeast Asia: Variable availability with strong competition from regional system builders securing supply.

Other Markets

- Latin America: Experiencing severe shortages with the highest relative price increases due to import dependencies.

- Africa and the Middle East: Severe availability constraints with premium pricing and reliance on gray market imports.

Industry Winners and Losers

The 2026 RAM crisis is creating clear winners and losers across the technology industry.

Winners

Memory Manufacturers:

- Samsung, SK Hynix, and Micron are the primary beneficiaries, with gross margins projected to exceed even TSMC’s in Q4 2025, a historic reversal reflecting the scarcity premium.

- Micron’s stock is up 247% over the past year, with net income nearly tripling in recent quarters.

- Samsung expects the December quarter 2025 operating profit to nearly triple.

- SK Hynix is considering a U.S. listing as its stock price surges; the company secured demand for its entire 2026 RAM production capacity in October 2025.

Major OEMs with Supply Contracts:

- Apple and Samsung are structurally hedged with cash reserves and long-term supply agreements, allowing them to secure memory supply 12-24 months in advance.

- Large enterprise PC manufacturers (Dell, HP, Lenovo) with advanced contracts and bulk purchasing power maintain better access than smaller competitors.

Losers

Budget-Focused Smartphone Manufacturers:

- Companies like Xiaomi, Oppo, Vivo, Realme, Honor, and Huawei operating on thin margins face severe pressure.

- These manufacturers have limited ability to absorb costs and must either raise prices (risking market share) or reduce specifications (hurting competitiveness).

Small System Integrators:

- Smaller PC builders and system integrators operating on lower margins struggle to secure supply and absorb costs.

- Industry observers predict consolidation, with many small SIs potentially not surviving through 2027 without income for extended periods.

- The big three manufacturers (Dell, HP, Lenovo) will likely weather the storm while smaller competitors struggle or fail.

PC Gaming Market:

- Custom PC builders and gaming enthusiasts face dramatically higher build costs, with memory potentially rivaling CPUs and GPUs as the largest single expense.

- Gaming PC market growth is being significantly dampened by affordability concerns.

Consumers:

- End users face higher costs across virtually all electronics, PCs, laptops, tablets, smartphones, gaming consoles, and more.

- Delayed upgrade cycles as consumers wait for better pricing or make do with existing hardware.

- Reduced specifications in mid-range products as manufacturers implement “shrinkflation” to maintain price points.

Frequently Asked Questions About the 2026 RAM Crisis

Q: Why are RAM prices so high in 2026?

RAM prices are high due to a combination of factors: (1) Memory manufacturers have reallocated significant production capacity to High Bandwidth Memory (HBM) for AI data centers and GPUs, reducing consumer RAM supply; (2) Deliberate phase-out of DDR4 production creating scarcity; (3) Growing consumer demand for higher memory capacities driven by AI PCs and local AI models; (4) Previous oversupply leading to production cuts that left the industry unable to respond quickly to surging demand.

Q: When will RAM prices go back to normal?

Industry experts’ consensus suggests significant price normalization is unlikely before late 2027 to 2028. Near-term outlook predicts prices will continue rising through mid-2026, with potential peak pricing around that time. Meaningful relief depends on new fabrication facilities coming online (2027-2028 timeframe) or a significant moderation in AI sector demand. SK Hynix, a major manufacturer, has indicated RAM shortages will persist through 2028.

Q: Should I buy RAM now or wait for prices to drop?

If you need memory for an immediate build or upgrade, industry experts recommend buying now rather than waiting. Prices are expected to continue rising through mid-2026, and waiting could mean paying significantly more. However, if your current system meets your needs adequately, waiting until late 2027 or 2028 for normalization may be more cost-effective. Consider your actual needs carefully; don’t upgrade just because you can.

Q: Is DDR4 or DDR5 a better value right now?

Despite DDR5 being more expensive in absolute terms (often 300-500% higher than early 2025 prices), it offers better value for new builds due to: superior performance and efficiency, better long-term platform compatibility, and increasingly better availability as DDR4 production winds down. DDR4 should only be purchased for existing legacy systems that cannot use DDR5. For any new build, DDR5 is the recommended choice despite higher current prices.

Q: Will SSD prices increase like RAM prices?

SSD prices are increasing, but not to the same extreme degree as RAM. NAND and DRAM use different manufacturing technologies and production lines. However, NAND costs have risen 246% since Q1 2025, and SSD prices are expected to increase 20-40% through 2026 as manufacturers prioritize AI server customers. The situation bears watching, but SSDs are not facing the same crisis severity as DRAM.

Q: How much has RAM increased in price since 2025?

Price increases vary by configuration: DDR5 32GB kits have increased 300-500% (from $90-120 to $310-450), DDR5 64GB kits have increased approximately 294% (from $180 to $710), DDR4 32GB kits have increased 100-200% (from $60-70 to $120-200), and high-capacity kits (128GB, 256GB) have seen increases of 150-275% depending on configuration and memory type.

Q: Why is AI causing RAM shortages?

AI is causing RAM shortages because training and running large language models require enormous amounts of specialized High Bandwidth Memory (HBM). Memory manufacturers are redirecting production capacity toward HBM because: (1) It’s far more profitable than consumer RAM; (2) Major tech companies (Google, Microsoft, Amazon, Meta) have placed massive orders for AI infrastructure; (3) Making one unit of HBM requires approximately 3x the wafer capacity of standard consumer RAM. OpenAI’s partnerships alone target 900,000 DRAM wafer starts per month, about 40% of total global DRAM output.

Q: Are there any alternatives to buying expensive RAM right now?

Yes, several alternatives exist depending on your situation:

(1) Consider pre-built systems from major manufacturers who have better access to supply through advanced contracts;

(2) Purchase refurbished or older-generation systems that include adequate RAM already.

(3) Maximize your current platform through other upgrades (storage, GPU, cooling) instead of a complete rebuild.

(4) For businesses, phase projects into stages, implement baseline configurations now, and expand later when conditions improve.

(5) If building new, start with adequate (but not excessive) RAM capacity and plan to expand when prices normalize.

Q: How does the 2026 RAM crisis compare to previous shortages?

The 2026 crisis is significantly more severe and longer-lasting than previous RAM shortages. While the 2016-2018 shortage saw prices roughly double over 18 months and the 2020-2021 pandemic shortage resulted in 30-60% increases, the current crisis has produced 300-500% increases in under 12 months. More critically, this shortage stems from fundamental, structural changes (HBM prioritization for AI) rather than temporary disruptions, making it likely to persist for 2-3 years rather than 12-18 months like previous crises.

Q: Will laptop and smartphone prices increase due to the RAM shortage?

Yes, consumer electronics prices are increasing significantly. Major PC vendors (Dell, Lenovo, HP, ASUS, Acer) have announced 15-20% price increases for the second half of 2026. IDC projects PC average selling prices could rise 6-8% in pessimistic scenarios. Smartphone manufacturers are either raising prices or implementing “shrinkflation” (reducing specifications while maintaining price points). Memory now represents approximately 20-25% of laptop bill of materials, up from 10-18% in early 2025. Budget-focused smartphone manufacturers are particularly pressured, with potential market contractions of up to 5% in pessimistic scenarios.

Key Takeaways and Final Recommendations

The 2026 RAM pricing crisis represents a fundamental restructuring of the global memory market driven by the explosive growth of artificial intelligence infrastructure. Unlike previous shortages caused by temporary disruptions, this crisis reflects permanent changes in manufacturing priorities that will shape the industry for years to come.

Essential Points to Remember:

- Scale: RAM prices have increased 300-500% for DDR5 and 150-200% for DDR4 since early 2025, with peak pricing expected around mid-2026.

- Timeline: Relief is unlikely before late 2027 to 2028 when new fabrication capacity comes online.

- Root Cause: The primary driver is manufacturers prioritizing High Bandwidth Memory (HBM) production for AI applications over consumer RAM.

- Broad Impact: The shortage affects virtually all consumer electronics, PCs, laptops, smartphones, tablets, gaming consoles, and graphics cards.

- Strategic Response: If you need memory now, buy immediately. If you can wait, consider delaying major upgrades until 2027-2028.

- Platform Choice: For new builds, prioritize DDR5 despite higher prices due to better long-term value and availability.