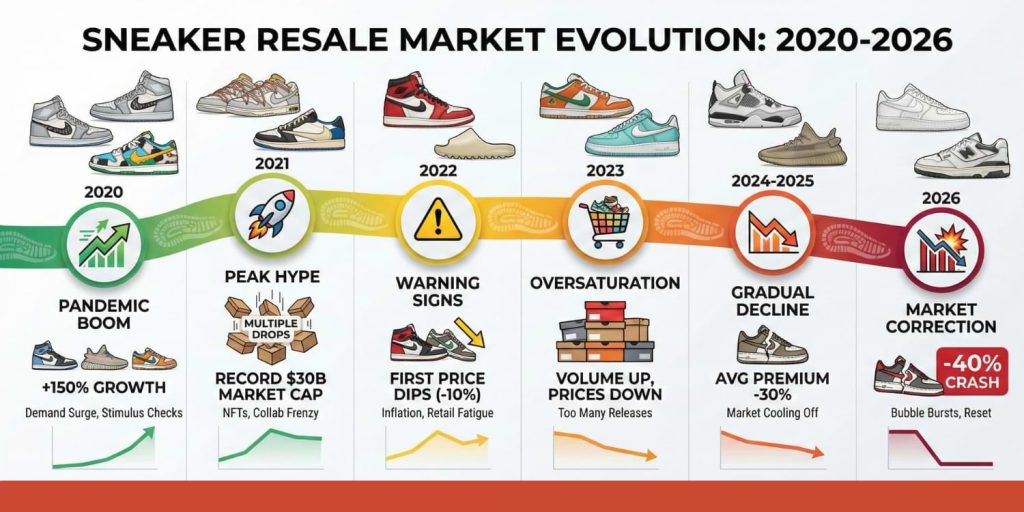

The sneaker resale market is undergoing its most significant correction in over a decade. After years of triple-digit markups and speculative buying, prices across major platforms have declined substantially, creating opportunities for informed consumers to find genuine deals. This analysis examines the data behind the correction and what it reveals about true sneaker value.

The Market Correction by the Numbers

The shift from hype-driven speculation to value-conscious buying is visible across every major metric. According to Resell Calendar and StockX data, in 2020, 58 percent of sneakers were trading above retail on secondary platforms. As of 2024, that number dropped to 47 percent.

This 11-percentage-point decline represents a fundamental market reset. Profit margins that once hit 100% are now closer to 10-25% per pair for most releases. For context, a reseller who previously cleared $150 on a single flip now struggles to net $30 after platform fees.

| Metric | 2020 Peak | 2024 Current | Change |

|---|---|---|---|

| Releases trading above retail | 58% | 47% | -11 points |

| Typical profit margins | 80-100% | 10-25% | -70% average |

| Average premium on general releases | 40-60% | 5-15% | Significant decline |

Despite compressed margins, the U.S. sneaker resale market is projected to hit $6 billion by the end of 2025, according to Resell Calendar, while a report from Future Market Insights values the global sneaker market at approximately $87 billion as of 2025.

What Caused the Correction?

Brand Oversupply

Nike increased production of popular styles like the Nike Dunk and the Air Jordan 1, resulting in oversaturation of the marketplace. When consumers can walk into any Foot Locker and find multiple Dunk colorways on shelves, secondary market premiums evaporate.

Starting in late 2023 and throughout 2024, the imbalance between supply and demand on the primary market flipped. Fewer sellouts and easier access to key releases at retail naturally drove down premiums on the secondary market.

Economic Pressures

“The consumer has been under inflationary pressure these last two years, so it’s no surprise that lower-priced sneakers are popular on our platforms,” said Sen Sugano, chief brand officer at GOAT Group. “Consumers are trending toward sneakers like Nike Dunks, Adidas Sambas, Gazelles, and Nike P-6000s.”

Shifting Consumer Sentiment

Industry observers noted that for a couple of years, the sneakers market behaved like a speculative asset, not dissimilar to NFTs. But sneakers are made to be worn, they are not speculative assets, and this tension eventually corrected itself.

Platform Fees: The Hidden Cost Eroding Value

Understanding platform fees is essential for calculating true value. These costs significantly impact both buyers and sellers, often turning apparent deals into break-even transactions.

| Platform | Seller Fees | Buyer Fees | Authentication |

|---|---|---|---|

| StockX | 9.5-13% + 2.9% cash-out | 3% processing + $13.95 shipping | Yes |

| GOAT | 9.5-15% + 5% cash-out | Varies by item | Yes |

| eBay | 0% on sneakers over $100 | Sales tax applies | Authentication guarantee |

| Poshmark | 20% flat | Included in price | Limited |

| Stadium Goods | 20% commission | Premium pricing | Yes |

With eBay charging up to 13%, StockX up to 19%, and Poshmark 20%, when you factor in payment processing fees of another 2-3%, shipping costs of $10-14, packaging materials, and potential returns, a $230 sale can quickly shrink to $35 actual profit.

For buyers, this means a sneaker listed at $200 actually costs $220-250 after all fees and shipping. Always calculate the complete out-the-door cost when comparing prices to retail alternatives.

Brand Performance: Winners and Losers

The correction has not affected all brands equally. While legacy players struggle with oversaturation, emerging brands are capturing market share.

Declining Performers

Nike and Jordan footwear prices on the secondary sneaker market continued to decline year on year in June 2025, by 6.8 percent and 5.6 percent, respectively.

Adidas x Wales Bonner collaboration premiums dropped from 74% in 2024 to 27% in 2025. Even the highly sought-after Samba has seen demand soften as the market reaches saturation.

Rising Performers

| Brand and Model | Growth Rate | Kyrie Irving partnership is driving sales |

|---|---|---|

| Anta | +1,901% | Casual designs are gaining traction |

| Asics Gel-Kayano 14 | +645% | Retro styles resonating with consumers |

| Nike Sabrina | +707% | Women’s basketball driving category growth |

| Mizuno | +124% | Casual designs gaining traction |

| Saucony | +59% | Performance and lifestyle crossover |

| Salomon | +58% | Trail-to-street aesthetic trending |

When Kyrie Irving signed with Anta after his Nike split, most U.S. resellers ignored it. The Kai 1 retailed for $120, and people questioned if there was even a market. Those who paid attention found steady flips at $180-220 with minimal competition.

The Women’s Market Opportunity

The women’s sneaker segment grew from 1.6% of the market in 2014 to 42.7% in 2022. This represents one of the most significant demographic shifts in sneaker history.

StockX saw more than 16,000 trades across 43 unique Nike Sabrina sneakers in 2024, a 707 percent increase from 2023. At GOAT Group, the Sabrina 1 and Sabrina 2 grew 401 percent in 2024.

For buyers, this means more inventory and better selection in women’s sizes. Women’s models from athletes like Sabrina Ionescu and Caitlin Clark are among the few categories still commanding consistent premiums.

High-Heat Exceptions That Still Command Premiums

While the broader market has cooled, certain categories continue performing:

| Release Type | Average Resale | Premium | Notes |

|---|---|---|---|

| Travis Scott x Jordan | $451 | 197% | Consistent performer |

| Mocha Jordan 1s (2023) | $1,000+ | 300%+ | Legacy hype model |

| Caitlin Clark Kobe 5 | Varies | 91% | Women’s sports driving demand |

| Limited artist collabs | Varies | 50-150% | Quality dependent |

Travis Scott’s collaborations with Jordan Brand continue to sell for massive premiums on the secondary market. On StockX, his shoes had an average resale price of $451 in 2024 and an average price premium of 197 percent.

However, these releases are rare. They prove that hype-driven scarcity still works, but the key is that you cannot build a buying strategy around hoping to hit one per year.

How to Identify True Value in the Current Market

Step 1: Establish the Retail Baseline

Before evaluating any resale price, know the original retail cost. A pair listed at $180 that retailed for $170 offers minimal value after platform fees consume the apparent savings.

Step 2: Research Production Numbers

Nike noticed the problem with oversaturation and cut production on limited Jordan releases by 35% to restore exclusivity. Shoes from genuinely limited runs maintain value better than those marketed as exclusive but produced in large quantities.

Step 3: Calculate Total Acquisition Cost

For a $200 resale sneaker on StockX:

- Listed price: $200

- Processing fee (3%): $6

- Shipping: $13.95

- State tax (varies): $15-20

- Total cost: $235-240

Compare this to retail alternatives before committing.

Step 4: Assess Condition and Authenticity

In 2024 alone, StockX noted they stopped more than 400,000 products from trading on the platform due to them not meeting verification standards, totaling nearly $85 million in products.

Market Outlook: Where Prices Are Heading

Industry experts suggest the correction may be approaching a healthier equilibrium. According to GOAT Group executives, the expectation is not to return to the type of premiums seen in 2020 and 2021, and that is actually positive. A healthier balance is emerging where products will sell out at retail, the hype model will work, and customers will find products on the secondary market at reasonable premiums.

The Business of Fashion’s sneaker market analysis notes that while the market has cooled, innovative releases and limited collaborations still command attention. Brands that master scarcity and storytelling will continue driving secondary demand.

Making Informed Purchasing Decisions

The sneaker resale correction reveals a fundamental truth: prices driven by speculation rather than genuine demand eventually find their natural level. For consumers willing to research rather than react, this creates opportunities to acquire desired pairs at rational prices.

Understanding how dynamic pricing affects perceived value helps decode why certain releases appear valuable while others languish. The same psychological mechanisms that inflate sneaker premiums operate across consumer markets, from electronics pricing patterns to luxury goods valuations.

For those tracking sneaker prices over time, platforms like Resell Calendar provide historical data that reveals whether current prices represent genuine deals or temporary dips before further declines.

The informed buyer’s advantage lies in distinguishing between manufactured scarcity and authentic value, a skill applicable far beyond footwear.

At OriginalPricing.com, we analyze pricing patterns across consumer markets to help buyers identify genuine value. Learn how shrinkflation affects everyday purchases, explore our methodology for pricing research, or discover how brands use perceived scarcity to inflate prices.